Get Nc Oic 100 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC OIC 100 online

Filling out the NC OIC 100 form can be a vital step for taxpayers seeking to settle their tax liabilities with the North Carolina Department of Revenue. This guide provides clear, step-by-step instructions to help you complete the form effectively and efficiently.

Follow the steps to complete the NC OIC 100 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

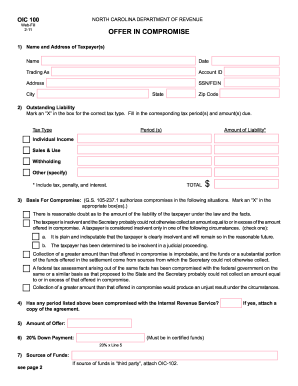

- In the first section, enter your name and address. Fill in details such as your trading name, Account ID, Social Security Number or Federal Employer Identification Number, city, state, and zip code.

- For the outstanding liability section, mark an 'X' in the box corresponding to the correct tax type. Then, fill in the applicable periods and the amounts you owe for each type of tax. Remember to include any taxes, penalties, and interest in the total amount.

- In the basis for compromise section, indicate by marking an 'X' the relevant circumstances justifying your request. This might include reasons such as reasonable doubt about the amount owed or insolvency.

- Answer the question about whether any period listed has been compromised with the Internal Revenue Service. If your answer is yes, attach the copy of the agreement.

- Define the amount of your offer, ensuring it is stated in certified funds.

- Calculate the 20% down payment based on the amount listed in your offer by multiplying it by 0.20.

- Submit details regarding the sources of funds. If a third party is listed as the source, remember to attach the OIC-102 form.

- In the explanation of circumstances section, clearly state the reasons you are requesting the compromise. Provide any supporting details or special circumstances affecting your ability to pay.

- Finally, sign and date the form, and provide your telephone number for any necessary follow-up.

- Once you have completed the form, you can save your changes, download a copy for your records, print it out, or share it as required.

Take the next step in managing your tax liabilities by completing the NC OIC 100 form online today.

Get form

Related links form

Claiming the North Carolina standard deduction can be beneficial if your total deductions do not exceed the standard amount. It simplifies the tax preparation process and may help reduce your taxable income. Evaluating your financial situation carefully is essential before making this decision. Utilizing tools like the NC OIC 100 can provide clarity on whether the standard deduction is right for you.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.