Loading

Get Nc E-595cf 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-595CF online

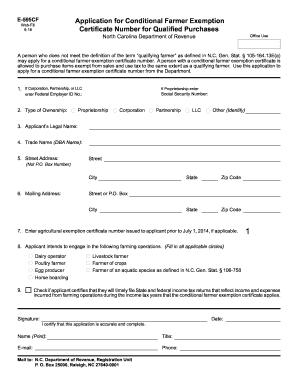

The NC E-595CF is an application for a conditional farmer exemption certificate number, allowing eligible individuals to purchase items exempt from sales and use tax. This guide provides clear instructions to assist you in completing the form online.

Follow the steps to successfully complete the NC E-595CF form.

- Press the ‘Get Form’ button to access the NC E-595CF application and open it in your editing platform.

- If you are applying as a corporation, partnership, or LLC, enter your Federal Employer Identification Number (FEIN). If you are a proprietorship, please provide your Social Security Number (SSN) in the designated spaces.

- Identify your type of ownership by selecting the appropriate circle for either proprietorship, corporation, partnership, or LLC.

- Enter the applicant’s legal name as it appears on official documents for which you are seeking the conditional farmer exemption certificate number.

- Input the trade name, also known as the doing business as (DBA) name, applicable to this application, if you have one.

- Fill out the street address where the applicant resides or conducts business. Do not use a P.O. Box number.

- Provide the mailing address where all official communications regarding the conditional farmer exemption certificate will be sent.

- If you have an agricultural exemption certificate number that was issued before July 1, 2014, please include it in the specified area. If this does not apply to you, leave it blank.

- Indicate the farming operations you intend to engage in by checking all applicable circles, such as dairy operator, poultry farmer, livestock farmer, etc.

- Check the box to certify that you will file timely State and federal income tax returns reflecting income and expenses from farming activities during the relevant tax years.

- Sign the form and include the date of the application. Print your name, title, phone number, and email address for further communication.

- Once completed, save the changes, and you may then download, print, or share the application before mailing it to the NC Department of Revenue, Registration Unit, P.O. Box 25000, Raleigh, NC 27640-0001.

Complete your application for the conditional farmer exemption certificate number online today.

NC withholding represents the amount of state income tax deducted from your paycheck to meet your tax obligations. This withholding is calculated based on your income and the information you provide on your NC tax forms. Understanding how NC E-595CF can impact your tax responsibilities can help you manage your finances effectively and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.