Loading

Get Nc E-585 Faq 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-585 FAQ online

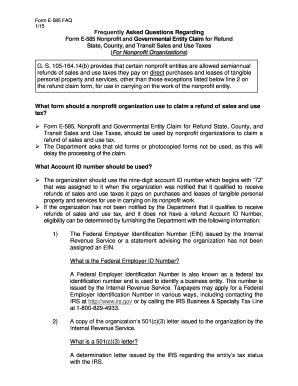

The NC E-585 FAQ is a crucial document for nonprofit organizations seeking refunds for sales and use taxes. This guide will provide you with clear, step-by-step instructions to help you navigate the online filling process effectively.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Identify your organization’s Account ID number, which is a nine-digit number beginning with '72'. This number allows your organization to claim refunds on sales and use taxes.

- Provide your Federal Employer Identification Number (EIN), which is crucial for identifying your organization.

- Submit your 501(c)(3) letter. This letter from the IRS confirms your organization’s tax-exempt status.

- Fill in the National Taxonomy of Exempt Entities (NTEE) Code, which classifies your nonprofit organization.

- Indicate the beginning and ending periods for your claims. Ensure you understand that the first half of the year (January 1 to June 30) claims are due by October 15, and the second half (July 1 to December 31) claims are due by April 15.

- Complete the relevant sections of the form regarding sales and use taxes paid directly or indirectly for purchases on which you seek refunds.

- If you made purchases in multiple counties, make sure to complete Form E-536R to detail each county's tax paid.

- After entering all required information, review your form for accuracy and completeness before submission.

- Finally, save your changes, then download and print the completed form for your records, or share it as needed.

Start completing your NC E-585 FAQ online today to ensure your organization receives the refunds it is entitled to.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can file your taxes through a variety of platforms, including online tax preparation services or directly through the North Carolina Department of Revenue. Using online tools can simplify the process and ensure accuracy. For more detailed recommendations, the NC E-585 FAQ discusses various filing options and benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.