Get Nc Dor Nc-4 Ez 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NC DoR NC-4 EZ online

How to fill out and sign NC DoR NC-4 EZ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans generally choose to handle their own tax returns and additionally, to complete forms electronically.

The US Legal Forms online service simplifies the process of electronically submitting the NC DoR NC-4 EZ, making it straightforward and user-friendly. Now, it will take only about thirty minutes, and you can complete it from anywhere.

Ensure you have accurately completed and submitted the NC DoR NC-4 EZ within the required timeframe. Be aware of any deadlines. Providing incorrect information on your tax documents can result in serious fines and complications with your annual tax return. Always utilize only approved templates from US Legal Forms!

- Launch the PDF form in the editor.

- Look at the specified fillable sections. This is where to enter your details.

- Select the option to check the checkboxes if you notice them.

- Navigate to the Text icon and other advanced options to manually adjust the NC DoR NC-4 EZ.

- Verify all your information prior to continuing to sign.

- Generate your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Validate your online document electronically and input the date.

- Click Done to proceed.

- Store or forward the document to the intended recipient.

How to modify Get NC DoR NC-4 EZ 2013: tailor forms online

Appreciate the user friendliness of the multi-featured online editor while completing your Get NC DoR NC-4 EZ 2013. Utilize the range of tools to swiftly fill out the blanks and provide the required information instantly.

Preparing documentation is time-consuming and expensive unless you have ready-made fillable forms and can complete them digitally. The most efficient method to handle the Get NC DoR NC-4 EZ 2013 is to utilize our professional and versatile online editing solutions. We furnish you with all the necessary tools for quick form completion and enable you to make any modifications to your templates, customizing them to any requirements. Additionally, you can comment on the revisions and leave notes for other participants.

Here’s what you can accomplish with your Get NC DoR NC-4 EZ 2013 in our editor:

Using Get NC DoR NC-4 EZ 2013 in our powerful online editor is the quickest and most efficient approach to organize, submit, and share your documentation as needed from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-capable device. All templates you generate or complete are securely stored in the cloud, so you can access them whenever necessary and have peace of mind about not losing them. Cease wasting time on manual document completion and eliminate paper; do everything online with minimal effort.

- Complete the empty fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize vital information with a chosen color or underline them.

- Hide confidential information using the Blackout tool or simply eliminate them.

- Add images to illustrate your Get NC DoR NC-4 EZ 2013.

- Substitute the original text with one that fits your requirements.

- Leave comments or sticky notes to communicate with others about the updates.

- Include additional fillable sections and assign them to specific individuals.

- Secure the document with watermarks, timestamps, and bates numbers.

- Distribute the document in multiple ways and save it on your device or in the cloud in various formats once you finish modifying.

Get form

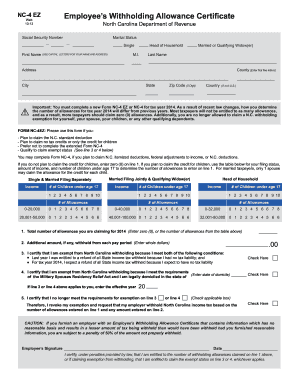

Filling out the NC 4EZ is required if you meet the criteria for its use, which generally includes having a simple tax situation. With the NC DoR NC-4 EZ, you can easily communicate your withholding preferences to your employer. At US Legal Forms, we offer resources that can guide you through completing the NC 4EZ accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.