Loading

Get Nc Dor Nc-4 Ez 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR NC-4 EZ online

Filling out the NC DoR NC-4 EZ form is essential to ensure proper withholding of North Carolina state income tax from your paychecks. This guide will provide clear instructions for each section of the form, making the process straightforward for users at all levels of experience.

Follow the steps to complete your NC DoR NC-4 EZ form online.

- Press the ‘Get Form’ button to access the NC-4 EZ form and open it in the editor.

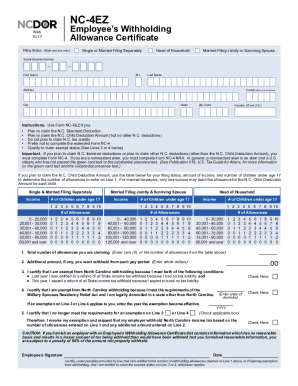

- Select your filing status by marking one box: Head of Household, Single or Married Filing Separately, or Married Filing Jointly or Surviving Spouse. This choice determines your tax obligations.

- Enter your Social Security number, first name, middle initial, and last name. Make sure these details are correct to avoid any delays.

- Fill in your county by entering the first five letters, and provide your full address including city, state, zip code, and country (if not the U.S.).

- Review the instructions on when to use this form, ensuring you meet the criteria such as planning to claim the N.C. Standard Deduction or N.C. Child Deduction Amount.

- Determine the total number of allowances you are claiming by using the appropriate table based on your filing status and income. Enter the number on Line 1.

- If you wish to have an additional amount withheld from each pay period, specify that amount on Line 2.

- If applicable, check to certify your exemption status as indicated in Lines 3 and 4. Ensure you include the effective date of the exemption if choosing Line 3 or Line 4.

- If you no longer meet the conditions for exemption, check the box to revoke your exemption and request withholding based on the allowances and additional amount entered.

- Provide your signature and the date, certifying that the information is correct and that you are entitled to the allowances claimed.

- Once all information is filled out and verified, users can save changes, download, print, or share the form at their discretion.

Complete your NC DoR NC-4 EZ form online today to ensure accurate tax withholding!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The number of allowances you should claim on form W-4P depends on your personal tax situation, including income level and dependents. Evaluating your financial landscape carefully will help ensure that you do not under-withhold taxes. Completing the NC DoR NC-4 EZ alongside your W-4P will provide a clearer picture of your overall tax strategy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.