Get Nc Dor Nc-4 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR NC-4 online

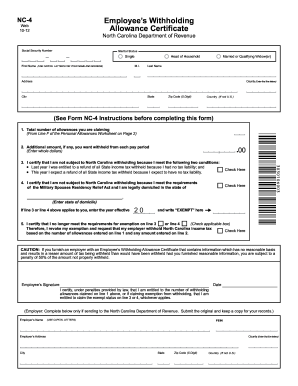

The NC DoR NC-4 is the Employee’s Withholding Allowance Certificate for North Carolina that allows users to specify their personal withholding allowances. Filling out this form correctly is essential for ensuring accurate tax withholding throughout the year.

Follow the steps to complete your NC DoR NC-4 online

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your social security number in the designated field.

- Select your marital status from the options provided: Head of Household, Single, or Married/Qualifying Widow(er).

- Input your first name, middle initial (if applicable), and last name in capital letters as instructed.

- Enter your county by typing the first five letters in the county field.

- Fill in your address, city, state, zip code, and country only if you reside outside of the U.S.

- Claim the total number of allowances by referring to Line F of the Personal Allowances Worksheet and entering that number.

- If you wish, specify any additional amount you would like withheld from each pay period in whole dollars.

- Indicate if you qualify for exemption from North Carolina withholding (lines 3 or 4) by checking the respective box and entering your state of domicile if applicable.

- If you no longer meet the requirements for exemption, check the box to revoke your exemption and request that tax withholding be based on the allowances and amounts you previously entered.

- Sign and date the form to certify that the information provided is accurate.

- If you are the employer, complete the employer section below the employee's signature, which includes the employer’s name, FEIN, and address.

- Once all fields are completed, save your changes, download, print, or share the form as needed.

Take action today and fill out your NC DoR NC-4 online for accurate withholding.

Get form

You will need to fill out the NC DoR NC-4 if you are an employee in North Carolina seeking to determine your state income tax withholding. Completing this form accurately is crucial for managing your tax liabilities throughout the year. If you expect to have taxes withheld, this form helps your employer calculate how much to deduct from your paychecks. If unsure, consider using our Legal Forms platform for guidance on this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.