Get Nc Dor Nc-4 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

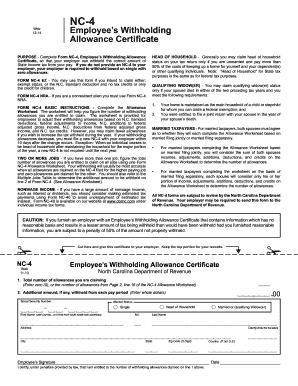

Tips on how to fill out, edit and sign NC DoR NC-4 online

How to fill out and sign NC DoR NC-4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans choose to complete their own tax returns and also to submit reports electronically. The US Legal Forms online service streamlines the process of filling out the NC DoR NC-4, making it quick and effortless. Now, it will take no longer than thirty minutes, and you can accomplish it from anywhere.

The easiest method to obtain the NC DoR NC-4 efficiently and effortlessly:

Ensure that you have accurately completed and dispatched the NC DoR NC-4 by the deadline. Consider any relevant terms. If you provide incorrect information with your financial documents, it could lead to hefty penalties and complications with your annual tax return. Utilize only professional templates with US Legal Forms!

Examine the PDF template in the editor.

Observe the highlighted fillable fields. This is where you need to enter your information.

Select the option to choose when you view the checkboxes.

Access the Text icon along with other robust features to manually modify the NC DoR NC-4.

Confirm all the information before you continue signing.

Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

Authenticate your PDF document online and indicate the date.

Click Done to proceed.

Store or transmit the document to the recipient.

How to modify Get NC DoR NC-4 2014: tailor forms online

Utilize the convenience of the versatile web-based editor while finalizing your Get NC DoR NC-4 2014. Take advantage of a variety of tools to swiftly complete the fields and furnish the necessary information immediately.

Drafting paperwork can be laborious and costly unless you possess pre-prepared fillable templates and finalize them digitally. The optimal approach to handle the Get NC DoR NC-4 2014 is by leveraging our expert and multifunctional online editing tools. We supply you with all the essential instruments for prompt document completion and enable you to modify any forms, adjusting them to meet any requirements. Furthermore, you have the option to leave remarks on the revisions and add notes for other parties involved.

Here’s what you can accomplish with your Get NC DoR NC-4 2014 using our editor:

Managing your Get NC DoR NC-4 2014 through our robust online editor is the fastest and most effective method to oversee, submit, and disseminate your documentation in a way that suits you from any place. The tool operates from the cloud, enabling access from any location on any internet-enabled device. All forms you create or prepare are safely stored in the cloud, ensuring you can always retrieve them when necessary and assuring you of their security. Stop expending time on tedious document filling and eliminate paperwork; handle everything online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Signature tools.

- Emphasize critical information with a preferred color or underline them.

- Obscure sensitive information using the Blackout feature or simply delete them.

- Upload images to illustrate your Get NC DoR NC-4 2014.

- Replace the original text with one that fulfills your needs.

- Add comments or sticky notes to relay updates to others.

- Create additional fillable fields and designate them to specific recipients.

- Secure the document with watermarks, date placements, and bates numbers.

- Distribute the documents through various means and save them on your device or in the cloud in multiple formats once you finish editing.

Get form

You can write 'exempt' on the NC 4 in the designated field provided on the form. This option is available for those who had no tax liability in the previous year and expect none in the current year. It’s crucial to provide accurate information when claiming exempt status to avoid underpayment issues. For further assistance, the US Legal Forms platform can guide you through this process smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.