Get Ms Dor 89-142 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

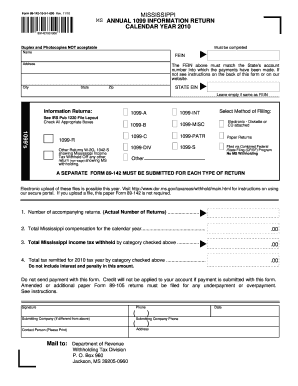

Tips on how to fill out, edit and sign MS DoR 89-142 online

How to fill out and sign MS DoR 89-142 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans seem to prefer to handle their own income taxes and, furthermore, to complete forms online. The US Legal Forms web-based platform simplifies the process of e-filing the MS DoR 89-142, making it efficient and convenient. It now takes no longer than thirty minutes, and you can do it from anywhere.

Guidelines for completing the MS DoR 89-142 quickly and effortlessly:

Ensure that you have accurately completed and submitted the MS DoR 89-142 on time. Pay attention to any relevant deadlines. If you provide incorrect information in your financial documents, it may result in substantial penalties and complications with your yearly tax return. Always utilize only reliable templates from US Legal Forms!

- Review the PDF template in the editor.

- Observe the designated fillable areas where you can enter your information.

- Select the checkbox option if needed.

- Explore the Text icon and additional advanced features for manual customization of the MS DoR 89-142.

- Verify all information prior to proceeding to sign.

- Generate your personalized eSignature using a keyboard, webcam, touchpad, mouse, or smartphone.

- Authenticate your PDF form electronically and specify the exact date.

- Click Done to proceed.

- Save or forward the document to the intended recipient.

How to Modify Get MS DoR 89-142 2010: Personalize Forms Online

Utilize our sophisticated editor to convert a straightforward online template into a finalized document. Continue reading to discover how to alter Get MS DoR 89-142 2010 online effortlessly.

Once you find a suitable Get MS DoR 89-142 2010, all you need to do is adapt the template to your requirements or legal stipulations. Besides populating the fillable form with precise information, you may want to delete some clauses in the document that do not pertain to your situation. Alternatively, you might consider adding some necessary terms in the original document.

Our advanced document modification tools are the optimal method to amend and customize the document.

The editor allows you to change the content of any form, even if the file is in PDF format. You can insert and remove text, add fillable areas, and make further adjustments while maintaining the original formatting of the document. Additionally, you can reorganize the document’s structure by altering page sequence.

There is no need to print the Get MS DoR 89-142 2010 to sign it. The editor includes electronic signature capabilities. Most forms already feature signature fields. Therefore, you just need to insert your signature and request one from the other signing party with a few clicks.

Once all parties finalize the document, you will receive a signed copy which you can download, print, and distribute to others.

Our services allow you to save significant time and minimize the likelihood of errors in your documents. Improve your document workflows with efficient editing tools and a robust eSignature solution.

- Open the desired form.

- Use the toolbar to modify the template to your liking.

- Fill in the form with accurate information.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to other signers if required.

You can pick up Mississippi tax forms at various locations such as local tax offices, public libraries, or even some post offices. It's advisable to check which forms are available before visiting. Alternatively, MS DoR 89-142 may have online resources that allow you to access and print the required forms right from home.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.