Loading

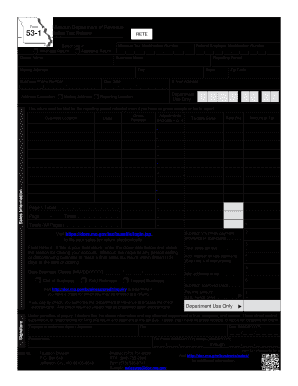

Get Mo Dor Form 53-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR Form 53-1 online

Filling out the MO DoR Form 53-1 online can simplify the process of submitting your sales tax return. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the MO DoR Form 53-1 online:

- Click the ‘Get Form’ button to access the form and open it in the designated editor.

- Enter your Missouri Tax Identification Number in the designated field.

- Choose whether you are filing an Amended Return or an Additional Return by checking the appropriate box.

- Fill in your Owner Name and Business Name accurately.

- Provide your Mailing Address, including the City, State, and Zip Code.

- Enter your Business Phone Number and E-mail Address for communication purposes.

- Specify the Reporting Period by filling in the Due Date accurately.

- List your Business Location and input Gross Receipts from sales for each location.

- Make any necessary Adjustments by indicating them in the appropriate section.

- Input the Taxable Sales amount for each business location.

- Enter the applicable Tax Rate percentage for each location.

- Calculate the Amount of Tax due and input that in the respective field.

- Compute the totals for each column and input these in the Totals section.

- Complete the Signature area by signing, adding your printed name, title, and date.

- You can now save changes, download, print, or share the completed form for submission.

Start completing your MO DoR Form 53-1 online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A no tax due statement in Missouri can be obtained by requesting it from the Missouri Department of Revenue. This document is essential if you're proving your tax status for various purposes. Be sure to include any relevant information and forms, such as the MO DoR Form 53-1, to facilitate the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.