Get Ca Ftb 3525 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

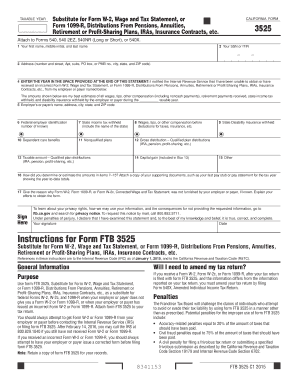

How to fill out the CA FTB 3525 online

Filling out the CA FTB 3525 online is a crucial step for individuals who have not received or have received incorrect wage and tax statements from their employers or payers. This guide provides a clear, step-by-step process to ensure accurate completion of the form for your tax records.

Follow the steps to successfully complete your CA FTB 3525 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In the first section, enter your first name, middle initial, and last name in the designated fields.

- Next, provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Ensure the number is accurate.

- Input your address, including number and street, apartment or suite number (if applicable), city, state, and ZIP code.

- At the end of the statement, enter the taxable year you are reporting.

- In the following fields, you need to describe your attempts to obtain the correct Form W-2 or Form 1099-R. Specify the employer's or payer's name and their address.

- Fill in the Federal Employer Identification Number (if known), or leave it blank.

- Next, record the state income tax withheld, including the name of the state.

- Provide details of wages, tips, or other compensation prior to any deductions.

- Enter information related to dependent care benefits, nonqualified plans, and taxable amounts for qualified plan distributions.

- Indicate any state disability insurance withheld and the gross distribution from qualified plans.

- Explain how you estimated the amounts in the previous fields and attach any supporting documentation, such as your last pay stub.

- In the final section, provide a reason why you did not receive the required forms and describe your efforts to obtain them.

- Sign the form, date it, and ensure to keep a copy for your records.

Complete your CA FTB 3525 online today to ensure your tax filing is accurate and complete.

Get form

Related links form

A business may be deemed tax-exempt based on various factors, including its purpose and organizational structure. Nonprofit organizations, educational institutions, and certain associations may qualify for tax exemptions if they serve public or charitable interests. To maintain compliance and ensure proper status, businesses should examine the criteria outlined in CA FTB 3525 and consult with tax professionals.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.