Loading

Get Mn Dor Schedule M1nr 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1NR online

Filling out the MN DoR Schedule M1NR can be a straightforward process if you follow the right steps. This guide provides clear instructions to help you fill out the form efficiently, ensuring you capture all necessary information accurately.

Follow the steps to complete your Schedule M1NR with confidence.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

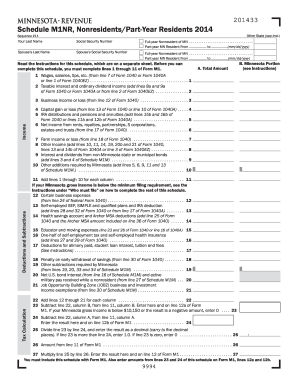

- Start by filling in your last name and Social Security number at the top of the form. Then indicate whether you are a full-year nonresident or part-year resident by checking the appropriate box and providing the residency dates if applicable.

- Proceed to part A where you will report your total income. Begin with line 1 to input your wages, salaries, or tips as reported on your federal income tax return.

- Continue with line 2 and enter taxable interest and ordinary dividend income. Make sure to sum these figures accurately as they contribute to your total income.

- Move to lines 3 through 10 to report other types of income, including business income, capital gains, and statutory inclusions. Carefully follow any specific instructions regarding what amounts to include or exclude.

- For lines 12 through 22, input deductions related to expenses and contributions, as prescribed. Include relevant expenses you incurred while residing in Minnesota, ensuring to adhere to the guidelines provided in the instructions.

- Next, subtract your total deductions from your total income as indicated in line 23, and continue to line 24 for the corresponding calculations.

- Finally, review all entries for accuracy. Save changes, download the completed form, and ensure to print it or share it as needed. Don't forget to include this schedule when submitting your Form M1.

Complete your Minnesota DoR Schedule M1NR online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The formula for gross income is simple: add up all sources of income, such as wages, rental income, and interest, minus any allowable deductions. This total provides you with your gross income, an important figure for tax filing. A clear understanding of this formula will help you when navigating forms like the MN DoR Schedule M1NR, ensuring you report your finances accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.