Get Mn Dor M4np 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M4NP online

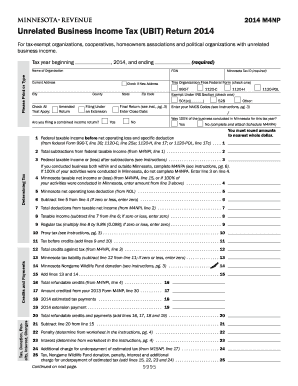

This guide provides a step-by-step overview for completing the Minnesota Department of Revenue M4NP form, which is used by tax-exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated business income. Follow this comprehensive guide to ensure accurate and efficient submission of your form online.

Follow the steps to successfully complete the MN DoR M4NP form online.

- Press the 'Get Form' button to access the MN DoR M4NP form online. This action will open the form in the editor for you to begin filling it out.

- Enter the tax year for which you are filing the return at the top of the form. This is important to correctly identify the period covered by your filing.

- Provide the name of your organization in the designated field. Make sure to spell it correctly as this will be the identifier for your filing.

- Check all applicable boxes that may apply to your organization, such as whether you are filing an amended return or if you have a new address.

- Enter the Minnesota Tax ID and FEIN (Federal Employer Identification Number) accurately, as these are required for processing your return.

- Complete Section for state and zip code, ensuring that the current address is entered correctly.

- Indicate if you are filing under an extension and check whether this is a final return for your organization.

- If applicable, indicate if you are filing a combined income return and detail the close date of your business activity.

- Detail your federal taxable income before net operating loss and specific deductions, referencing the correct line from your federal form.

- List all allowable subtractions from your federal taxable income as instructed, and sum these to ensure accuracy.

- Calculate the taxable net income for Minnesota before the application of deductions or losses.

- Ensure you calculate any necessary credits against tax, detailing them clearly for thorough processing.

- Review all inputs for accuracy before finalizing your entries.

- Finalize the form by saving changes, and choose to download, print, or share the document as needed.

Complete the MN DoR M4NP form online today to ensure your tax-exempt organization remains compliant.

Get form

Related links form

When answering 'Are you exempt from withholding?', consider your tax situation carefully. If you expect to owe no tax or had no tax liability in the previous year, you may be able to check the exemption box. However, if your circumstances are different, it’s usually better to withhold to avoid any surprises. Referencing the MN DoR M4NP can provide clarity on your specific case.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.