Loading

Get Mn Dor M1prx 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M1PRX online

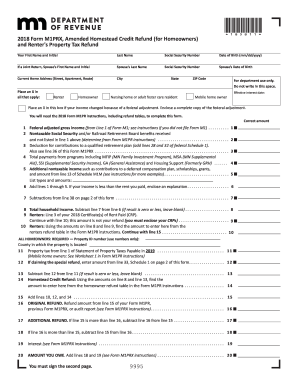

Filling out the MN DoR M1PRX form can be an important step for homeowners and renters seeking to amend their property tax refund. This guide provides clear instructions to help you successfully complete the form online, ensuring your information is accurate to facilitate timely processing.

Follow the steps to complete the MN DoR M1PRX online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, last name, and middle initial in the designated fields. Make sure all names are spelled correctly.

- Provide your Social Security number and date of birth in the specified format (mm/dd/yyyy). If filing jointly, enter your spouse’s information as well.

- Fill in your current home address, including street, apartment number (if applicable), city, state, and ZIP code.

- Select whether you are a renter or homeowner by placing an X in the appropriate box. If applicable, also indicate if you are a nursing home resident.

- Provide your federal adjusted gross income, nontaxable Social Security benefits, and deductions for retirement contributions as instructed.

- List any additional nontaxable income, including contributions to deferred compensation plans, scholarships, and grants.

- Calculate your total household income by adding specific lines as instructed, then deduct any subtractions as needed.

- If you are a renter, enter the amount from your Certificate(s) of Rent Paid. All homeowners must enter their Property ID number.

- Refer to the homeowner refund table or renters refund table in the instructions to determine the appropriate refund amount to enter.

- Enter any original refund amounts, additional refunds, or amounts owed as specified in the subsequent lines.

- Complete the signature section on page two of the form, including both your signature and your spouse's, if applicable.

- Review all information for accuracy, then save your changes, download, print, or share the form as necessary.

Complete your MN DoR M1PRX online today to ensure your property tax adjustments are processed efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, TurboTax supports the M1PR form, making it easier for you to file for a Minnesota property tax refund. Using TurboTax can streamline your filing process, as it automatically pulls in your necessary information. For those looking to claim their refund via M1PRX, this integration simplifies the task significantly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.