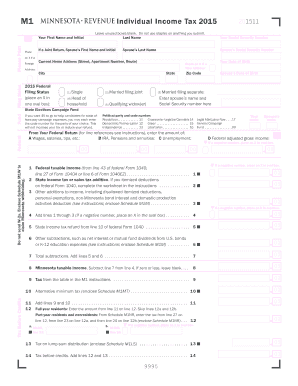

Get Mn Dor M1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN DoR M1 online

How to fill out and sign MN DoR M1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans prefer to manage their own tax filings and, in addition, to complete forms in digital format.

The US Legal Forms online platform facilitates the process of e-filing the MN DoR M1 quickly and efficiently. Now it will take no more than thirty minutes, and you can do it from anywhere.

Ensure that you have correctly completed and submitted the MN DoR M1 in a timely manner. Check any relevant deadlines. Providing incorrect information in your tax documents may lead to hefty penalties and complications with your yearly tax filings. Always use only professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Refer to the highlighted fillable fields. This is where you will enter your details.

- Click on the selection option if you find the checkboxes.

- Explore the Text tool and additional advanced features to modify the MN DoR M1 manually.

- Review all the details before you proceed with signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF document online and indicate the specific date.

- Click Done to proceed.

- Save or dispatch the document to the intended recipient.

How to modify Get MN DoR M1 2015: personalize forms online

Completing documents is straightforward with intelligent online resources. Eliminate paperwork with easily accessible Get MN DoR M1 2015 templates you can modify online and print.

Creating documents and paperwork should be more user-friendly, whether it is a regular aspect of one’s job or infrequent tasks. When one needs to submit a Get MN DoR M1 2015, learning regulations and instructions on how to accurately fill out a form and what it should encompass can be time-consuming and demanding. Nevertheless, if you discover the correct Get MN DoR M1 2015 template, completing a document will no longer be difficult with an efficient editor available.

Explore a wider range of functionalities you can incorporate into your document management routine. There’s no need to print, complete, and annotate forms by hand. With a clever editing platform, all necessary document processing capabilities are readily available. If you seek to enhance your workflow with Get MN DoR M1 2015 forms, locate the template in the catalog, choose it, and discover an easier way to fill it out.

- If you wish to insert text in any part of the form or add a text field, utilize the Text and Text field tools to expand the text in the form to your liking.

- Leverage the Highlight tool to emphasize the important sections of the form. If you need to obscure or delete certain text portions, apply the Blackout or Erase tools.

- Personalize the form by incorporating default graphic elements. Utilize the Circle, Check, and Cross tools to include these features in the forms, if applicable.

- For extra comments, use the Sticky note tool and place as many notes on the forms page as necessary.

- If the form requires your initials or date, the editor provides tools for this as well. Reduce the likelihood of mistakes using the Initials and Date tools.

- Adding custom graphic elements to the form is also simple. Use the Arrow, Line, and Draw tools to personalize the document.

Get form

Setting up a payment plan for MN taxes involves contacting the Minnesota Department of Revenue and discussing your financial situation. You may need to fill out forms for the MN DoR M1 and provide details about your income and expenses. A payment plan allows you to manage your tax debt effectively over time. Resources like uslegalforms can assist you in understanding your options.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.