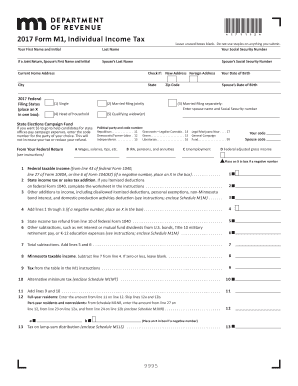

Get Mn Dor M1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN DoR M1 online

How to fill out and sign MN DoR M1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, a majority of Americans prefer to handle their own tax returns and also to complete forms digitally.

The US Legal Forms online service simplifies the process of submitting the MN DoR M1, making it straightforward and free of complications.

Ensure that you have accurately completed and submitted the MN DoR M1 within the required timeframe. Consider any relevant deadlines. Providing incorrect information in your financial statements can result in serious penalties and complications with your yearly tax return. Always utilize professional templates from US Legal Forms!

- Access the PDF template in the editor.

- Observe the designated fillable spaces. This is where you will enter your information.

- Select the option if you notice the checkboxes.

- Utilize the Text tool along with other effective features to manually modify the MN DoR M1.

- Review all the information prior to signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your online template and indicate the specific date.

- Click on Done to proceed.

- Download or forward the file to the recipient.

How to Modify Get MN DoR M1 2017: Personalize Forms Online

Your swiftly adjustable and adaptable Get MN DoR M1 2017 template is readily accessible. Utilize our library featuring a built-in online editor.

Do you delay assembling Get MN DoR M1 2017 because you simply don’t know where to start and how to proceed? We sympathize with your situation and possess an excellent resource for you that has nothing to do with overcoming your hesitation!

Our online inventory of pre-made templates allows you to sort and select from countless fillable forms tailored for various objectives and situations. But acquiring the file is merely the beginning. We furnish you with all the necessary tools to complete, endorse, and alter the template of your choice without departing our website.

All you need to do is to access the template in the editor. Verify the wording of Get MN DoR M1 2017 and confirm whether it meets your expectations. Initiate completing the form by utilizing the annotation tools to give your document a more structured and polished appearance.

In conclusion, along with Get MN DoR M1 2017, you will receive:

With our fully equipped option, your completed forms will always be legally binding and entirely encrypted. We ensure to protect your most sensitive information.

Equip yourself with everything needed to create a professionally appealing Get MN DoR M1 2017. Make a wise decision and try our platform today!

- Insert checkmarks, circles, arrows and lines.

- Emphasize, redact, and amend the existing text.

- If the template is also meant for other individuals, you can incorporate fillable fields and distribute them for others to complete.

- Upon finishing the template, you can download the file in any available format or select any sharing or delivery methods.

- A powerful suite of editing and annotation tools.

- An integrated legally-binding eSignature solution.

- The capability to create forms from scratch or based on the pre-uploaded template.

- Compatibility with different platforms and devices for enhanced convenience.

- Multiple options for securing your files.

- A variety of delivery choices for smoother sharing and dispatching of files.

- Adherence to eSignature regulations governing the use of eSignature in electronic transactions.

Get form

Related links form

Yes, as a non-resident, you are required to file taxes if you earn income from Minnesota sources. This entails reporting your income on the MN DoR M1 form, even if you reside outside the state. Filing your taxes accurately ensures that you stay compliant and avoid potential penalties. Make sure to review your tax obligations thoroughly to avoid any surprises.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.