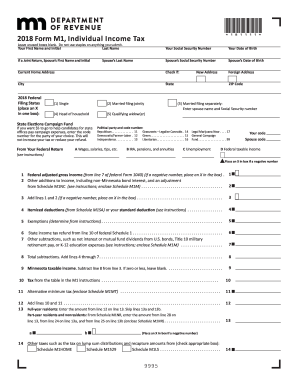

Get Mn Dor M1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN DoR M1 online

How to fill out and sign MN DoR M1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans seem to favor managing their own taxes and, indeed, to complete reports in digital format.

The US Legal Forms online platform facilitates the process of e-filing the MN DoR M1 effortlessly and without complications.

Ensure that you have correctly filled out and submitted the MN DoR M1 by the deadline. Take into account any relevant time frame. Providing inaccurate information in your tax documents may lead to severe penalties and complications with your annual tax filing. Only utilize reliable templates with US Legal Forms!

- Access the PDF template in the editor.

- Refer to the marked fillable sections. Here you can input your information.

- Click on the option to select if you notice the checkboxes.

- Explore the Text icon along with other advanced options to manually adjust the MN DoR M1.

- Review all the information before you proceed to sign.

- Create your unique eSignature using a keyboard, digital camera, touchpad, computer mouse, or smartphone.

- Authenticate your digital document and enter the specific date.

- Click on Finish to proceed.

- Download or forward the document to the intended recipient.

How to modify Get MN DoR M1 2018: personalize forms online

Experience the capabilities of the comprehensive online editor while finalizing your Get MN DoR M1 2018. Utilize the variety of tools to swiftly complete the fields and submit the necessary information promptly.

Creating documents is labor-intensive and costly unless you have pre-prepared editable templates and can finalize them digitally. The optimal approach to tackle the Get MN DoR M1 2018 is to leverage our expert and versatile online editing solutions. We offer you all the pivotal tools for rapid document completion and enable you to make any modifications to your forms, tailoring them to specific requirements. Furthermore, you can annotate the amendments and leave remarks for others involved.

Here’s what you can accomplish with your Get MN DoR M1 2018 in our editor:

Managing the Get MN DoR M1 2018 in our robust online editor is the fastest and most efficient method to control, submit, and share your paperwork according to your needs from anywhere. The tool runs in the cloud allowing you to access it from any location on any internet-enabled device. All forms you create or finish are securely stored in the cloud, enabling you to retrieve them whenever required and ensuring their safety. Stop spending time on manual document preparation and cut down on paper; perform everything online with minimal effort.

- Complete the fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize important details with a preferred color or underline them.

- Conceal confidential information using the Blackout tool or simply delete it.

- Add visuals to enhance your Get MN DoR M1 2018.

- Substitute the original text with one that meets your specifications.

- Include comments or sticky notes to communicate with others regarding the changes.

- Create additional fillable sections and designate them to specific individuals.

- Secure the document with watermarks, insert dates, and bates numbers.

- Distribute the document in multiple formats and save it on your device or the cloud in various file types after completing the edits.

Get form

Amending a tax return can be a wise decision, particularly if you discover an error that may change your tax liability. By filing an MN DoR M1 amendment, you take responsibility for your filings and can potentially recover overpaid taxes. Always weigh the benefits against any penalties, and consider using a reliable platform like US Legal Forms to simplify the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.