Loading

Get Mn Dor Ig260 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR IG260 online

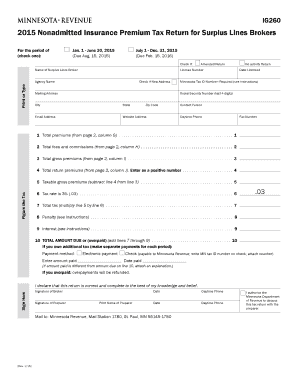

Filling out the Minnesota Department of Revenue Form IG260 online can be a straightforward process when you have a clear guide. This document is required for surplus lines brokers to report their nonadmitted insurance premium taxes, and understanding each section will help ensure accurate and timely submissions.

Follow the steps to successfully complete the IG260 form online.

- Click the ‘Get Form’ button to access the IG260 document and open it in your online editor.

- Begin by entering your name as the surplus lines broker in the designated field. Ensure you also include your license number. This information is essential for proper identification.

- Provide your agency name, and if applicable, check the box for a new address. Fill in your mailing address, ensuring that all details are current and accurate.

- Select if you are filing an amended return or a no activity return by checking the relevant box. This step clarifies your filing intentions to the Department.

- Fill in the required Minnesota Tax ID number. If you do not possess one, ensure to apply for it as instructed. Enter the last four digits of your social security number, if applicable.

- Proceed to the premium sections: record the total premiums, total fees, total gross premiums, and total return premiums. Ensure that these values are accurate and reflect the amounts from page 2 of the form.

- Calculate your taxable gross premiums by subtracting the total return premiums from the total gross premiums. Enter the result in the appropriate field.

- Apply the tax rate of 3% (0.03) to the taxable gross premiums to compute the total tax. Ensure this calculation is performed accurately.

- If applicable, enter any penalties and interest from late payments as instructed. This ensures that you account for all potential additional amounts due.

- Before finalizing the document, review all entries for accuracy. You may then save changes, download, print, or share the completed IG260 form as required.

Complete your IG260 form online today to ensure compliance with Minnesota tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Amending a tax return can be a good idea if you discover errors or missed deductions, as it may lead to a refund. Utilizing resources like the MN DoR IG260 can provide you with the necessary information to make confident adjustments. However, consider the time and potential penalties involved before proceeding.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.