Loading

Get Mn Dor C58p 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR C58P online

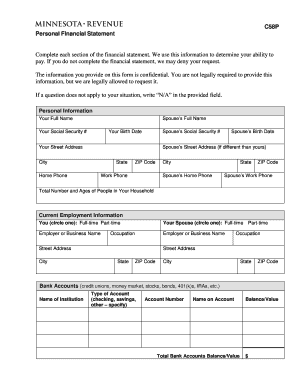

The MN DoR C58P form, also known as the personal financial statement, is essential for assessing your financial situation. Completing this form accurately is crucial for determining your eligibility for payment agreements or other financial requests.

Follow the steps to successfully complete your financial statement.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Input your personal information, including your full name, Social Security number, birth date, and contact details. Ensure that you also include information for your spouse, if applicable.

- In the current employment information section, indicate whether you and your spouse are employed full-time or part-time. Enter your employer's name, occupation, and address.

- Proceed to list your bank accounts. Provide the name of the institution, account type, account number, name on account, and the total balance or value of each account.

- Next, detail your real estate holdings by providing the county, address, mortgage balance, current value, and minimum monthly payment for each property owned.

- Fill in the credit card section by providing the card name, credit limit, current balance, and minimum monthly payment for each card.

- Document your motor vehicles by listing the year/make, model, balance due, financed by, and payoff date. Also, include the minimum monthly payment for your vehicles.

- In the living expenses section, provide a detailed account of your monthly expenses, ensuring you include all relevant categories like rent, taxes, insurance, and groceries.

- Report any other obligations and their balances. This may include home equity loans and personal loans. Ensure you specify the total minimum monthly payment.

- Total your monthly expenses, combining all amounts reported in previous sections. This ensures a comprehensive view of your financial commitments.

- List your income by detailing your gross monthly pay, spouse's income, and any other sources of income like alimony or Social Security.

- If additional information is relevant, provide this in the designated section, attaching extra pages if necessary.

- Sign and date the authorization section at the bottom of the form to affirm the accuracy of the information provided.

- For those requesting a payment agreement, complete the related section carefully, including proposed payment specifics and bank information.

- Review all entries for accuracy before saving changes, downloading, printing, or sharing the completed form.

Start filling out your MN DoR C58P form online today to manage your financial obligations effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Checking the status of your Minnesota refund is straightforward through the state's online portal. Input your vital information for immediate updates. Additionally, you can refer to the MN DoR C58P for more detailed instructions and support regarding your refund status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.