Loading

Get Mn Cr-ippc (formerly Pte-pc) 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN CR-IPPC (formerly PTE-PC) online

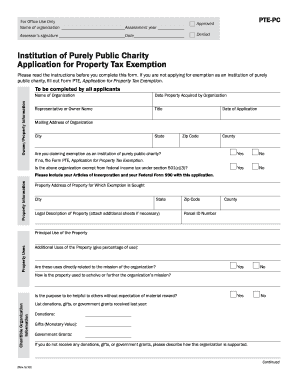

Filling out the MN CR-IPPC form online is a critical step for organizations seeking property tax exemption as an institution of purely public charity. This guide provides comprehensive instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your organization’s name and the assessment year. Make sure to fill in the date property was acquired by your organization, the name of the representative or owner, their title, and the date of application.

- Next, indicate the state and county in which your organization is located. Fill in the mailing address and ensure the city and zip code are correctly entered.

- Answer the question about claiming exemption as an institution of purely public charity by selecting 'Yes' or 'No.' If you answer 'No,' please file Form PTE instead.

- Provide information about the property. State if your organization is exempt from federal income tax under section 501(c)(3). Ensure to attach your Articles of Incorporation and Federal Form 990.

- Fill in the property address for which the exemption is sought, including city, state, zip code, and county. Provide the legal description of the property and parcel ID number if applicable.

- Explain the principal use of the property and any additional uses. Indicate if these uses are related to your organization’s mission and elaborate on how the property furthers this mission.

- In the charitable organization section, confirm if the purpose is to assist others without expecting material reward. List any donations, gifts, or government grants received last year and explain how your organization is supported if no funds are received.

- Answer questions regarding the provision of goods or services at reduced or no cost. Provide examples where applicable.

- Verify if any organization profits are distributed to private interests or if the beneficiaries of the charity are restricted. Provide explanations where required.

- Finally, sign the form as the owner or authorized representative, providing your name, phone number, and date.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your MN CR-IPPC form online now to ensure your organization benefits from property tax exemption.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.