Loading

Get Ak 623i 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 623i online

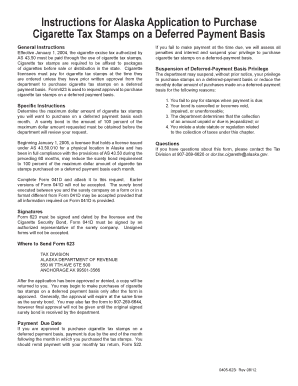

The AK 623i form is essential for requesting approval to purchase cigarette tax stamps on a deferred payment basis in Alaska. This guide will provide you with a detailed, step-by-step approach to completing the form correctly and efficiently online.

Follow the steps to ensure successful completion of the AK 623i form.

- Click the 'Get Form' button to obtain the AK 623i form and access it in your preferred editing tool.

- Begin by filling in your personal information, including your name, business name, and contact details as required in the specified fields. Accuracy is important for proper identification.

- Determine the maximum dollar amount of cigarette tax stamps you plan to purchase on a deferred payment basis each month. Ensure that this amount aligns with your business needs and compliance requirements.

- Attach a surety bond for 100 percent of the maximum dollar amount requested. Make sure that this bond is obtained before submitting the form, as it is a requirement for review.

- Review the eligibility criteria to potentially reduce your surety bond requirement if your license has been in good standing for the previous 60 months. Enter any relevant information that supports your request.

- Sign and date the form in the designated area to validate your request. This is necessary for the form to be accepted, so make sure your signatures are clear.

- Ensure to complete and attach Form 041D along with Form 623. Earlier versions of Form 041D are not acceptable, so verify that you are using the current version.

- Once everything is complete, submit the form to the Alaska Department of Revenue, Tax Division at the specified address, or fax it to the provided number. Keep a copy of the submitted forms for your records.

- After submission, await a response about the approval or denial of your application. You may only begin purchasing stamps on a deferred payment basis once you receive approval.

- If approved, remember that payment for cigarette tax stamps is due by the end of the following month after purchase. Plan ahead to ensure timely remittance with your monthly tax return, Form 522.

Complete your AK 623i application online with confidence to successfully request your deferred payment privileges.

Corporate entities that have a higher taxable income on their regular tax return than the limit set by the IRS must file for the corporate alternative minimum tax. This includes corporations with significant deductions or tax credits. Companies should stay informed about these requirements and consider using US Legal Forms to navigate potential obligations related to AK 623i.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.