Loading

Get Mi Transfer Of Ownership Guidelines 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Transfer of Ownership Guidelines online

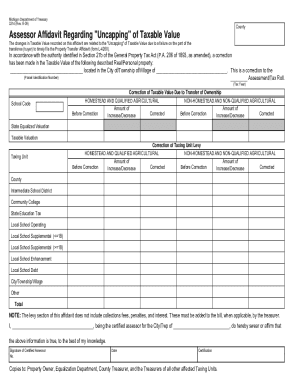

Filling out the MI Transfer of Ownership Guidelines form accurately is crucial for compliance with Michigan property tax laws. This guide will provide clear and concise steps to help you complete the form online with ease.

Follow the steps to successfully complete the MI Transfer of Ownership Guidelines.

- Press the ‘Get Form’ button to access the MI Transfer of Ownership Guidelines document and open it in your preferred online editor.

- Begin by reviewing the background information provided at the start of the document to understand the significance of the transfer of ownership concerning property taxes. This section outlines the implications of ownership changes.

- Identify the specific type of transfer of ownership that applies to your situation from the definitions provided in the document. Make sure you clearly understand whether your transfer qualifies and note any relevant details.

- Fill out sections related to the type of transfer you are reporting. This may include information regarding deeds, land contracts, leases, or trusts, depending on your specific circumstances.

- Ensure that you accurately complete all required fields, such as the names of the parties involved, the date of the transfer, and any applicable exemptions.

- Review the exemption criteria carefully to determine if any apply to your situation. This is crucial for ensuring your transfer is reported correctly and to avoid unnecessary taxation.

- Once you have completed all sections and reviewed your entries for accuracy, save the changes to your document.

- Download the completed document for your records. Additionally, consider printing it or sharing it with the applicable authorities as needed.

Submit your completed MI Transfer of Ownership Guidelines form online to ensure timely compliance with property tax regulations.

Related links form

Ownership in Michigan is transferred through a legal document called a deed, which needs to be recorded with the local county clerk. The MI Transfer of Ownership Guidelines lay out the steps required to file this document correctly. It's important to ensure that all necessary documents are prepared accurately to avoid legal complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.