Loading

Get Mi Mi-w4 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-W4 online

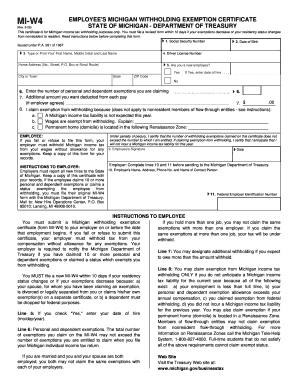

Filling out the MI MI-W4 form is essential for Michigan income tax withholding purposes. This guide will walk you through each section of the form, helping you complete it accurately and efficiently.

Follow the steps to complete the MI MI-W4 online.

- Click 'Get Form' button to access the MI MI-W4 form and open it in the editor.

- Enter your Social Security number in the designated field. This number is necessary for identification purposes.

- Provide your date of birth in the appropriate format. This helps verify your identity.

- Type or print your first name, middle initial, and last name clearly in the corresponding field.

- Input your driver license number to offer additional identification.

- Fill in your home address, including the house number, street name, city or town, state, and ZIP code. Ensure that all details are accurate.

- Indicate whether you are a new employee by selecting 'Yes' or 'No.' If you answered 'Yes,' enter your date of hire in the provided space.

- Specify the number of personal and dependent exemptions you are claiming. This number should reflect your eligible exemptions.

- If applicable, enter any additional amount you want deducted from each pay period in the corresponding field.

- In section 8, indicate if you claim exemption from withholding status, and provide the necessary explanation if applicable.

- Sign and date the form at the bottom. This signature certifies the accuracy of the information provided and acknowledges the consequences of false statements.

- Review the completed form for accuracy, then save your changes, download, print, or share the form as needed.

Complete your MI MI-W4 form online today to ensure accurate tax withholding!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If your employer never had you complete a W-4 form, it’s essential to address this promptly. You can request a W-4 from your employer and fill it out to ensure proper tax withholding. Using the correct MI-W4 helps prevent any surprises during tax season and ensures that your withholdings align with your financial situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.