Loading

Get Mi Mi-1310 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1310 online

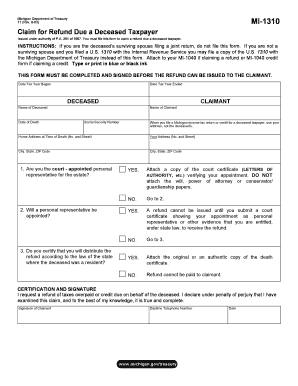

The MI MI-1310 form is essential for claiming a refund due to a deceased taxpayer in Michigan. This guide will provide you with detailed instructions on how to accurately fill out this form online, ensuring a smooth and efficient process.

Follow the steps to successfully complete the MI MI-1310 form.

- Click ‘Get Form’ button to access the MI MI-1310. This will allow you to download and open the form in the editor of your choice.

- In the designated fields, enter the date the tax year began and the date the tax year ended. These dates are crucial for processing your claim efficiently.

- Provide the name of the deceased individual, along with their date of death. Accurate information is necessary to validate the claim.

- Fill in the claimant's name and social security number. If you are not the surviving spouse, ensure your information is complete.

- Enter the home address at the time of death for the deceased, followed by your own current address. This will help the authorities confirm your identity.

- Answer the question regarding whether you are the court-appointed personal representative for the estate. If yes, you must attach a copy of the court certificate verifying your appointment.

- If you are not the personal representative, you will need to provide evidence that you are entitled under state law to receive the refund.

- Next, determine if a personal representative will be appointed for the estate. This affects how the refund can be processed.

- Certify that you will distribute the refund according to the law of the state where the deceased was a resident. This is a legal affirmation necessary for completing the form.

- Sign the form where indicated, and include your daytime telephone number and the date of signing. This ensures that your claim is complete.

- Once you have completed all required fields and attached any necessary documents, save your changes. You can download, print, or share the form as needed.

Complete the MI MI-1310 form online today to ensure your claim for refund is processed promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Typically, you do not need to send a death certificate to the IRS when filing a deceased person's tax return. However, it's advisable to be prepared to provide it if requested, particularly when claiming a refund using Form 1310. Keeping a copy on hand can help streamline communication with the IRS regarding your filing of the MI-1310. Always ensure you retain necessary documentation for your records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.