Loading

Get Mi Mi-1310 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1310 online

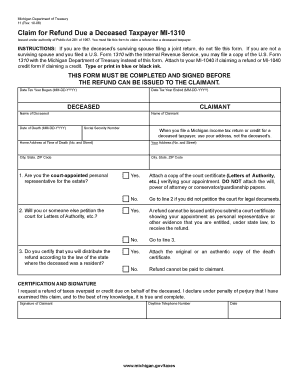

Filling out the MI MI-1310 form is an essential process for claiming refunds due to a deceased taxpayer. This guide will help you navigate through each section of the form accurately and efficiently, ensuring that you understand the requirements and can complete the process with ease.

Follow the steps to accurately complete the MI MI-1310 form

- Click the ‘Get Form’ button to access the MI MI-1310 form and open it in your chosen form management tool.

- Begin by entering the date when the tax year commenced in the MM-DD-YYYY format.

- Next, enter the date when the tax year concluded, also in MM-DD-YYYY format.

- In the 'Deceased' section, provide the name of the deceased individual and the date of their death.

- In the 'Claimant' section, fill in your name and Social Security number as the person seeking the refund.

- Use your address in the form and not the deceased’s. Fill in your home address, including the number and street information.

- Input your city, state, and ZIP code, followed by the corresponding information for the deceased.

- Answer the first question regarding your status as a court-appointed personal representative for the estate.

- Respond to the second question about whether you or someone will petition the court for necessary legal documents.

- Certification is critical; ensure you indicate your intent to distribute the refund according to state law.

- If necessary, attach a copy of the court certificate or other required documentation as stated.

- Sign the form, and provide your daytime telephone number to ensure contactability.

- Finally, enter the date on which you are filling out the form, and check over all information for completeness and accuracy.

- After reviewing, you can save changes, download, print, or share the form as needed.

Complete your MI MI-1310 form online for a smooth and efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Processing form 1310 typically follows the same timeline as other IRS forms, often taking around 21 days for electronic submissions. Paper submissions may take longer, so consider e-filing for quicker results. Always verify the status for updates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.