Loading

Get Mi Mi-1310 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1310 online

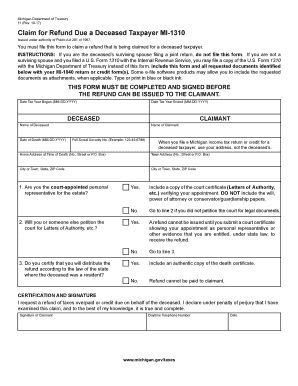

The MI MI-1310 form is essential for claiming a refund on behalf of a deceased taxpayer in Michigan. This guide will provide you with step-by-step instructions on how to accurately complete and submit this form online, ensuring a smooth process.

Follow the steps to complete the MI MI-1310 form online.

- Click the ‘Get Form’ button to access the MI MI-1310 document and open it in the editor.

- Start filling out the form by entering the date the tax year began and the date it ended in the specified format (MM-DD-YYYY).

- In the 'DECEASED' section, input the name of the deceased and their date of death.

- Complete the 'CLAIMANT' section with your name and full Social Security number.

- Use your personal address instead of the deceased’s address when filling out your address details.

- Answer the questions regarding your status as the court-appointed personal representative and if you will petition the court for Letters of Authority.

- Provide certification by signing the form, including your daytime telephone number and the date of signing.

- Ensure all required documents, such as the death certificate and court certificate, are prepared to be attached before submission.

- Review the completed form for accuracy. Once satisfied, save your changes, then download, print, or share the form as necessary.

Start filling out your MI MI-1310 form online today to ensure a timely processing of your claim.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For most returns, including those with the MI MI-1310, the processing time is around 21 days. However, certain factors, such as missing information or errors on the form, can delay processing. Always double-check your submission to avoid unnecessary delays and stay informed by checking your IRS status online.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.