Get Mi Mi-1310 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI MI-1310 online

How to fill out and sign MI MI-1310 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans seem to favor handling their own tax returns and additionally filling out documents in digital format.

The US Legal Forms online service streamlines the preparation of the MI MI-1310, making it quick and convenient.

Ensure that you have accurately completed and submitted the MI MI-1310 in a timely manner. Keep any deadlines in mind. Providing inaccurate information on your financial documentation can result in hefty penalties and complications with your annual tax return. Utilize only professional templates available through US Legal Forms!

- Open the PDF form in the editor.

- Look for the highlighted fillable fields, which is where you will input your information.

- Select the option if checkboxes are visible.

- Use the Text tool and other advanced functionalities to manually edit the MI MI-1310.

- Review every detail before you continue to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authorize your document electronically and indicate the specific date.

- Click on Done to proceed.

- Store or send the document to the intended recipient.

How to modify Get MI MI-1310 2018: personalize forms on the web

Utilize our sophisticated editor to transform a basic online template into a finished document. Continue reading to discover how to alter Get MI MI-1310 2018 online effortlessly.

Once you locate a suitable Get MI MI-1310 2018, all you need to do is tailor the template to your tastes or legal necessities. Besides filling out the customizable form with precise details, you might need to remove certain clauses in the document that are unrelated to your situation. Conversely, you may wish to add any missing stipulations in the original form. Our advanced document editing functionalities are the easiest method to correct and modify the document.

The editor permits you to change the content of any form, even if the file is in PDF format. You can add and delete text, insert fillable fields, and implement additional alterations while retaining the original formatting of the document. Additionally, you can reorganize the layout of the document by adjusting the page sequence.

You do not have to print the Get MI MI-1310 2018 to endorse it. The editor includes electronic signature features. Most forms already have signature fields. Thus, you simply need to input your signature and request one from the other party to sign with just a few clicks.

Follow this detailed guide to create your Get MI MI-1310 2018:

After all parties have finished the document, you will receive a signed copy that you can download, print, and distribute.

Our services allow you to save a significant amount of time and reduce the likelihood of errors in your documents. Improve your document workflows with efficient editing tools and a robust electronic signature solution.

- Access the desired form.

- Utilize the toolbar to modify the form to your liking.

- Complete the form supplying accurate details.

- Click on the signature field and add your electronic signature.

- Send the document for approval to other signers if needed.

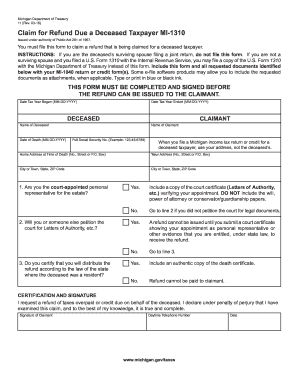

The personal representative or executor of the deceased person's estate is responsible for signing the tax return. They must ensure that the MI MI-1310 form is accurately completed and submitted. If there is no designated representative, the next of kin can sign on behalf of the deceased. For any clarifications or support in this process, uslegalforms is available to assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.