Loading

Get Mi Mi-1040d 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1040D online

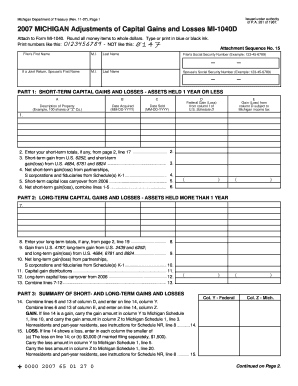

Filling out the MI MI-1040D form online can simplify the process of reporting your capital gains and losses on your Michigan income tax return. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately.

Follow the steps to complete the MI MI-1040D online.

- Click ‘Get Form’ button to access the MI MI-1040D form and open it in your preferred editor.

- Enter your first name in the designated filer’s name field. If filing jointly, include your partner's first name along with their information.

- Fill in your last name and that of your partner, if applicable, in the appropriate fields.

- Provide your Social Security number using the format: 123-45-6789. Ensure that both filers’ Social Security numbers are entered correctly.

- Move on to Part 1 for short-term capital gains and losses. Here, list each asset held for one year or less, providing the description, dates of acquisition and sale, and the relevant gains or losses.

- Continue to Part 2 for long-term capital gains and losses, reporting assets held for more than one year in a similar manner.

- In Part 3, summarize your total short-term and long-term gains and losses as directed. Make sure to follow the calculation guidelines provided.

- If you have additional information to report, complete Parts 4 through 6 as needed. This may include carryovers and additional calculations from previous years.

- Review all entries for accuracy to minimize errors. Once you are satisfied, you can save your changes, download a copy, print, or share the completed form as necessary.

Begin filling out your MI MI-1040D online today and ensure your capital gains and losses are accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you earn income in Michigan, it is likely that you need to file a state tax return using the MI MI-1040D. Certain income thresholds and specific criteria will determine your filing requirement. Consulting with resources like USLegalForms can simplify the process of understanding your filing obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.