Loading

Get Mi Itd Employer's Withholding Registration And Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI ITD Employer's Withholding Registration and Instructions online

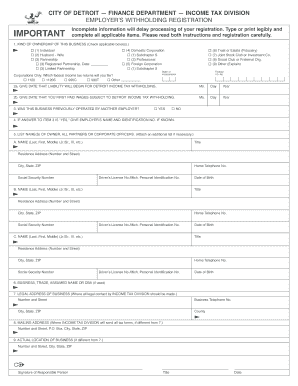

Filling out the MI ITD Employer's Withholding Registration and Instructions is essential for employers operating within the City of Detroit. This guide provides detailed, step-by-step instructions to help you complete the registration online accurately and efficiently.

Follow the steps to complete your registration with ease.

- Press the ‘Get Form’ button to access the MI ITD Employer's Withholding Registration form and open it in your editor.

- Identify the kind of ownership of your business and check the applicable box(es). Options include individual, partnership, domestic corporation, and others. If your business is a corporation, indicate the type of federal income tax returns you will file.

- Provide the date that your liability for Detroit income tax withholding will begin. Fill in the month, day, and year accurately.

- Specify the date you first paid wages subject to Detroit income tax withholding by entering the required month, day, and year.

- Indicate whether your business was previously operated by another employer. If yes, provide the previous employer's name and identification number if known.

- List the names of all owners, partners, or corporate officers. Include their titles, residence addresses, social security numbers, home telephone numbers, and driver's license numbers. Use additional pages if needed.

- Fill in the business name, legal address, and contact information accurately. This is where all legal communication should be sent.

- Provide the mailing address if it differs from the legal address of the business. This is where tax forms will be sent.

- Enter the actual location of the business if it is different from the legal address provided.

- The responsible person should sign and print their title along with the date of signing to complete the form.

- Once all fields are completed, make sure to save changes. You have the option to download, print, or share the filled-out form as needed.

Complete your MI ITD Employer's Withholding Registration online today to ensure compliance and timely processing.

Related links form

When filing federal copies of forms 1099 with the IRS from the state of Michigan the mailing address is: Department of the Treasury , Internal Revenue Service Center , Kansas City, MO 64999.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.