Loading

Get Mi Form 1019 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form 1019 online

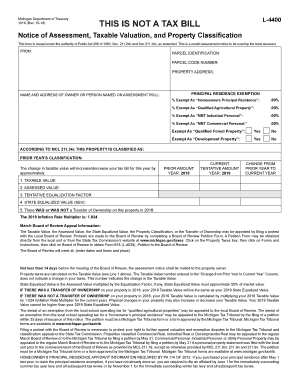

Filling out the MI Form 1019 online can streamline the process of assessing your property valuation and classification. This guide offers detailed, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the MI Form 1019 online

- Press the ‘Get Form’ button to access the MI Form 1019 and open it in your document editor.

- Enter the parcel identification details, including the parcel code number and the property address. Ensure this information is accurate to avoid delays.

- Fill in the name and address of the owner or the person listed on the assessment roll.

- Input the principal residence exemption percentages for categories such as 'Homeowners Principal Residence', 'Qualified Agricultural Property', and 'MBT Industrial Personal'. If any exemptions apply, provide the respective percentages.

- Answer the exemption questions regarding 'Qualified Forest Property' and 'Development Property' by selecting 'Yes' or 'No'.

- Review the classification of the property according to the current regulations, which may include the prior year's classification.

- Provide details regarding the change in taxable value that will affect your tax bill.

- Complete sections on taxable value, assessed value, tentative equalization factor, and state equalized value. Ensure that these entries are correct and reflect any transfers of ownership.

- Prior to submitting the form, double-check all entries for accuracy.

- Once completed, save your changes, and utilize options to download, print, or share the form with relevant parties.

Start filling out your MI Form 1019 online to ensure accurate property assessment today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file Michigan taxes, you generally need forms including MI Form 1019, along with your federal tax forms. It’s vital to gather all necessary documentation to ensure a smooth filing process. Missing information can delay your tax return. Online platforms like USLegalForms can simplify this by providing the forms and guidance you need for successful filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.