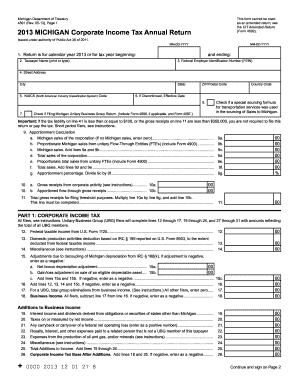

Get Mi Dot 4891 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI DoT 4891 online

How to fill out and sign MI DoT 4891 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans choose to manage their own income taxation and, in fact, to complete forms electronically.

The US Legal Forms online service streamlines the process of e-filing the MI DoT 4891, making it straightforward and free of complications.

Ensure that you have accurately completed and submitted the MI DoT 4891 on schedule. Be mindful of any relevant deadlines. If you provide incorrect information in your financial reports, it may result in significant penalties and complications with your annual tax return. Utilize only approved templates from US Legal Forms!

- Launch the PDF template in the editor.

- Review the highlighted fillable sections. Here, you can input your information.

- Select the option to mark when you encounter the checkboxes.

- Advance to the Text tool along with other advanced features to manually adjust the MI DoT 4891.

- Verify all the information before you continue to sign.

- Generate your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Verify your PDF form electronically and include the date.

- Click on Done to proceed.

- Save or send the document to the recipient.

How to modify Get MI DoT 4891 2013: personalize forms on the web

Select a trustworthy document editing solution that you can depend on. Modify, implement, and validate Get MI DoT 4891 2013 securely on the internet.

Often, dealing with forms like Get MI DoT 4891 2013 can be challenging, particularly when you receive them in a digital format without access to specific software. While there are alternatives to navigate this, you may produce a form that does not meet the submission criteria. Utilizing a printer and scanner is not a viable solution either, as it consumes time and resources.

We offer a simpler and more efficient method for completing documents. An extensive collection of template documents that are easy to modify and validate, enabling fillability for others. Our service extends far beyond just a selection of templates. A key benefit of our service is that you can edit Get MI DoT 4891 2013 directly through our platform.

Being an online solution, it eliminates the need to download any software. Moreover, not all corporate policies allow installation on professional devices. Here’s how to effortlessly and securely process your documents with our service.

Disregard paper and other inefficient methods of completing your Get MI DoT 4891 2013 or any other documents. Utilize our tool, which combines one of the most comprehensive libraries of editable forms with robust document editing services. It's simple, secure, and can save you considerable time! Don't just take our word for it; try it for yourself!

- Click on Get Form > and you will be taken to our editor immediately.

- Once the editor is open, you can commence the editing process.

- Select checkmarks or circles, lines, arrows, crosses, and additional options to annotate your document.

- Choose the date field to add a specific date to your template.

- Include text boxes, graphics, notes, and more to enhance the content.

- Make use of the fillable fields option on the right to create fillable {fields.

- Select Sign from the top toolbar to create your legally-binding signature.

- Press DONE and save, print, share, or download the final output.

Get form

Obtaining a PDF tax form is straightforward. You can visit the Michigan Department of Treasury website to download forms such as the MI DoT 4891 directly to your device. Alternatively, uslegalforms offers an excellent platform where you can access and download various tax forms, making it easy to find what you need.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.