Get Mi Dot 4891 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI DoT 4891 online

How to fill out and sign MI DoT 4891 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, a majority of Americans tend to favor handling their own income tax returns and, indeed, completing forms in digital format.

The US Legal Forms browser interface simplifies the e-filing process for the MI DoT 4891, making it both easy and efficient.

Ensure that you have accurately completed and submitted the MI DoT 4891 on time. Keep in mind any relevant deadlines. Providing incorrect information on your tax documents can lead to serious penalties and complications with your yearly tax filing. Utilize only official templates from US Legal Forms!

- Launch the PDF template in the editor.

- Consult the specified fillable areas where you can input your information.

- Select the option if you see any checkboxes.

- Access the Text tool and additional advanced features to manually modify the MI DoT 4891.

- Confirm all the information before proceeding to sign.

- Create your distinctive eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF document online and indicate the specific date.

- Press Done to continue.

- Store or send the document to the intended recipient.

How to alter Get MI DoT 4891 2014: personalize forms online

Ditch the conventional paper-based method of completing Get MI DoT 4891 2014. Get the form finalized and verified in moments with our expert online editor.

Are you compelled to edit and complete Get MI DoT 4891 2014? With a professional editor like ours, you can accomplish this task in just a few moments without the hassle of printing and scanning documents repeatedly. We offer fully adjustable and simple form templates designed to assist you in filling out the necessary form online.

All documents, by default, include fillable fields ready for you to complete upon opening. However, if you wish to refine the existing content of the document or introduce new elements, you can select from various editing and annotation tools. Emphasize, obscure, and comment on the document; add checkmarks, lines, text boxes, graphics, notes, and comments. Additionally, you can quickly certify the document with a legally-recognized signature. The finalized document can be shared with others, stored, dispatched to external applications, or transformed into any popular format.

You won’t regret choosing our web-based tool to finalize Get MI DoT 4891 2014 because it's:

Don't waste time handling your Get MI DoT 4891 2014 the antiquated way - with pen and paper. Take advantage of our comprehensive solution instead. It presents you with a full suite of editing tools, integrated eSignature functionality, and ease of use. What sets it apart is its team collaboration features - you can collaborate on documents with anyone, construct a structured document approval workflow from start to finish, and much more. Experience our online solution and receive excellent value for your investment!

- Simple to set up and navigate, even for users who haven’t filled out documents electronically before.

- Powerful enough to handle diverse editing needs and form types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible on various devices, making it easy to complete the form from virtually anywhere.

- Capable of creating forms based on pre-drafted templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Related links form

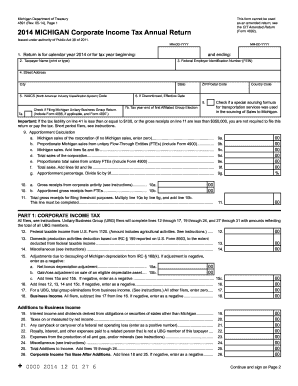

Michigan Form 4891 must be filed by corporations that are subject to the Michigan Corporate Income Tax. This includes C Corporations and S Corporations operating within the state. It's essential for entities to meet their tax filing obligations on time to avoid penalties. If you require assistance, uslegalforms can facilitate the process and provide the necessary resources for filing.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.