Loading

Get Mi Dot 4582 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4582 online

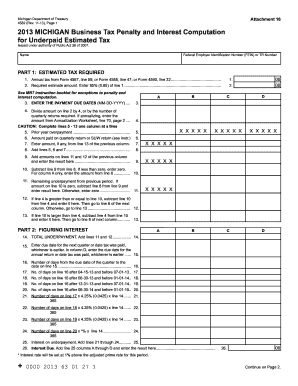

Filling out the MI DoT 4582 form can seem challenging, but this guide aims to simplify the process. This form is used to compute penalties and interest for underpaid estimated taxes, ensuring that you stay compliant with Michigan tax regulations.

Follow the steps to complete the MI DoT 4582 online.

- To obtain the form, click the 'Get Form' button to open it in the designated editor.

- Begin by filling in your name and Federal Employer Identification Number (FEIN) or TR Number at the top of the form.

- In Part 1, enter the annual tax from the applicable forms (4567, 4588, or 4590) in line 1, and calculate 85% of this amount for line 2.

- Input the payment due dates in line 3 in MM-DD-YYYY format based on your filing schedule.

- For line 4, divide the estimated amount on line 2 by four or by the required number of quarterly returns.

- Proceed to complete lines 5 through 13 one column at a time, entering prior year overpayment, amounts paid on quarterly returns, and other required figures.

- Move to Part 2, where you will figure the interest due by calculating the number of days between due dates and payment dates.

- Navigate to Part 3 and calculate any penalties based on the days past due, using the appropriate percentages.

- In Part 4, use the Annualization Worksheet if applicable, ensuring to complete all relevant lines if your tax liability is not evenly distributed.

- Once all sections are completed, make sure to review and verify all entered information for accuracy.

- Finally, save your changes, download the form, and prepare to print or share it as necessary for your filing.

Complete your MI DoT 4582 form online to ensure timely compliance with Michigan tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Acquiring an EIN number, or Employer Identification Number, is straightforward. You can apply directly through the IRS website. As part of this process, you will need your business information on hand, ensuring the details match what you provide in the MI DoT 4582 application. Utilizing platforms like uslegalforms can simplify this procedure, guiding you through the necessary steps.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.