Loading

Get Mi Dot 4582 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4582 online

This guide provides a comprehensive, step-by-step overview for completing the MI DoT 4582 form online. Designed for ease of understanding, it addresses each component of the form to assist users of all backgrounds in navigating this essential tax document.

Follow the steps to complete the MI DoT 4582 effectively.

- Press the ‘Get Form’ button to obtain the MI DoT 4582 form and open it in your editor.

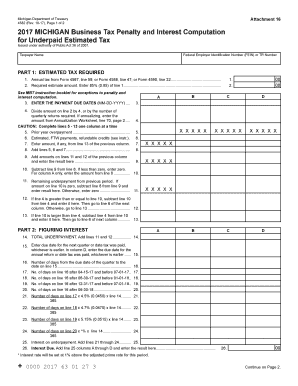

- Begin by entering your taxpayer name and Federal Employer Identification Number (FEIN) or TR Number in the designated fields.

- Proceed to Part 1, where you will need to calculate your estimated tax required. Refer to previous tax forms (Form 4567, 4588, or 4590) for annual tax amount and enter it.

- Calculate 85% of the annual tax amount from line 1 and enter this figure in line 2.

- Enter due dates for the payments in line 3 in the MM-DD-YYYY format.

- Divide the amount on line 2 by 4 (or the number of required quarterly returns) and input this value in line 4.

- Continue completing Part 1 by filling out lines 5 through 13 methodically, ensuring to add each section's amounts correctly.

- Move on to Part 2, where you will calculate interest by following the prompts for each line, ensuring to correctly enter due dates and numerical calculations.

- In Part 3, determine any applicable penalties by providing the necessary information and following the specific line instructions.

- Lastly, complete Part 4 if necessary, using it to calculate the annualization worksheet and ensuring the result reflects the required estimates.

- Review all entered information for accuracy. Once confirmed, you can choose to save changes, download, print, or share the completed form.

Complete your MI DoT 4582 form online to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filing Michigan Form 5081 involves completing the form accurately and submitting it to the Michigan Department of Treasury. The form is used for payroll tax withholding purposes. You can utilize the MI DoT 4582 system for guidance on how to fill out and submit your form efficiently, ensuring compliance with Michigan's tax requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.