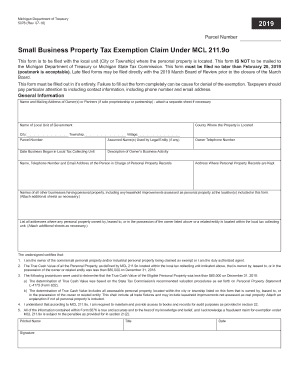

Get Mi 5076 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI 5076 online

How to fill out and sign MI 5076 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans prefer to handle their own tax returns and also to complete forms in digital format.

The US Legal Forms online platform simplifies the process of submitting the MI 5076, making it convenient.

Ensure that you have accurately completed and submitted the MI 5076 on time. Be aware of any deadlines. If you enter incorrect information in your financial statements, it may lead to significant penalties and complications with your annual tax filing. Always utilize certified templates from US Legal Forms!

- Open the PDF template in the editor.

- Observe the highlighted fillable sections. This is where you will input your details.

- Select the appropriate option when you come across the checkboxes.

- Move to the Text icon alongside other useful features to manually edit the MI 5076.

- Review all the information prior to completing the signing process.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF document online and enter the date.

- Click on Done to proceed.

- Download or forward the document to the intended recipient.

How to modify Get MI 5076 2019: personalize forms online

Authorize and distribute Get MI 5076 2019 alongside any additional business and personal papers online without squandering time and resources on printing and mailing. Optimize your use of our online document editor with a built-in compliant eSignature feature.

Authorizing and submitting Get MI 5076 2019 templates digitally is faster and more efficient than handling them on paper. However, it necessitates utilizing online methods that guarantee a high degree of data security and offer you a verified tool for generating electronic signatures. Our robust online editor is precisely what you need to prepare your Get MI 5076 2019 and other personal, business, or tax forms accurately and appropriately in line with all the guidelines. It includes all the essential tools to swiftly and effortlessly complete, modify, and sign documents online and incorporate Signature fields for others, specifying who and where should sign.

It takes only a few simple steps to finalize and sign Get MI 5076 2019 online:

Share your document with others through one of the available methods. When authorizing Get MI 5076 2019 with our powerful online tool, you can always be confident that it will be legally binding and admissible in court. Prepare and submit documents in the most effective manner possible!

- Open the chosen file for further editing.

- Utilize the top toolbar to include Text, Initials, Image, Check, and Cross marks to your document.

- Highlight the most important information and obscure or eliminate sensitive parts if needed.

- Click on the Sign tool above and select your preferred method to eSign your document.

- Draw your signature, input it, upload its image, or use another option that fits you.

- Switch to the Edit Fillable Fields panel and drop Signature areas for other participants.

- Click on Add Signer and enter your recipient’s email to assign this area to them.

- Ensure all information provided is complete and accurate before clicking Done.

Get form

Related links form

Qualifying for farm property tax exemption in Michigan requires that you use your property primarily for farming purposes and comply with income and production criteria. Filing Michigan Form 5076 accurately demonstrates your eligibility to local authorities. Knowing the specific guidelines and maintaining good records of your farming activities can help you secure this exemption.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.