Loading

Get Me 941p-me Instructions 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME 941P-ME Instructions online

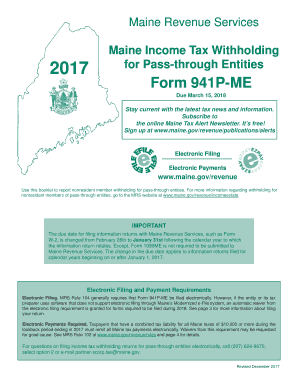

Filling out the ME 941P-ME Instructions online can streamline your process of reporting nonresident member withholding for pass-through entities. This guide provides clear and detailed steps to help you accurately complete the form, ensuring you comply with Maine's tax regulations.

Follow the steps to efficiently complete the ME 941P-ME Instructions online.

- Press the ‘Get Form’ button to access the ME 941P-ME Instructions, opening it in your preferred online format.

- Enter the entity information by providing the name, address, and federal identification number of the pass-through entity. Ensure all details are accurate to avoid issues during processing.

- Indicate if you are submitting an amended return by checking the amended return box. Fill out all relevant lines, including entering the original amounts when applicable.

- Complete Line A by checking the box if there are members exempt from withholding as compliant taxpayers or composite filers, and fill out Schedule 3P.

- List the total number of nonresident members during the reporting period on Line B.

- Calculate and enter the total amount of pass-through entity withholding on Line 1, ensuring it matches with Forms 1099ME issued.

- Report total estimated withholding payments made in Line 2 and calculate any amounts due or overpaid on Lines 3a and 3b.

- Check the tiered entity box if applicable and include necessary statements about other entities involved.

- Complete Schedule 1P regarding entity apportionment by providing Maine and total U.S. sales figures.

- Fill out Schedule 2P for pass-through entity withholding, providing detailed information for each member and their respective withholding amounts.

- Complete Schedule 3P for members exempt from withholding, ensuring to follow the specified instructions related to their identification and participation.

- Review all sections for accuracy, then save your changes, download a copy, print, or share the completed form as needed.

Complete the ME 941P-ME Instructions online to ensure accurate tax reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain a Maine tax ID number by registering your business with the Maine Revenue Services. This process can be completed online or via mail, depending on your preference. For a step-by-step guide, the ME 941P-ME Instructions are your best resource.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.