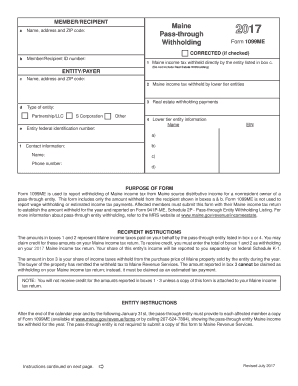

Get Me 1099me 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ME 1099ME online

How to fill out and sign ME 1099ME online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own income tax returns and additionally prefer to fill out documents in digital format.

The US Legal Forms online platform facilitates the e-filing process of the ME 1099ME, making it straightforward and user-friendly. Now, it will take no longer than 30 minutes, and you can accomplish this from any site.

Ensure that you have accurately completed and submitted the ME 1099ME on time. Take note of any applicable deadlines. Providing inaccurate information in your financial statements can lead to significant penalties and complications with your annual tax return. Only utilize reliable templates from US Legal Forms!

- Open the PDF template in the editor.

- View the designated fillable areas where you can enter your information.

- Select the option by clicking on the checkboxes as needed.

- Utilize the Text tool along with additional advanced features to manually modify the ME 1099ME.

- Double-check all details before proceeding to signature.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your online template electronically and enter the date.

- Click Done to proceed.

- Download or forward the document to the recipient.

How to modify Get ME 1099ME 2017: personalize forms online

Have the appropriate document modification tools at your disposal. Complete Get ME 1099ME 2017 with our reliable tool that comes equipped with editing and electronic signature capabilities.

If you seek to process and validate Get ME 1099ME 2017 online effortlessly, then our web-based solution is the optimal choice. We provide an extensive library of template-based forms that you can modify and complete online. Moreover, you won't be required to print the document or use external options to make it fillable. All necessary tools will be at your disposal as soon as you access the document in the editor.

Let's explore our online modification tools and their key features. The editor boasts an intuitive interface, so it won't take much time to learn how to use it. We will review three primary sections that allow you to:

In addition to the features listed above, you can secure your document with a password, apply a watermark, convert the document to the required format, and much more.

Our editor simplifies the process of modifying and certifying the Get ME 1099ME 2017. It enables you to accomplish nearly everything regarding form management. Additionally, we ensure that your experience with documents is secure and adheres to major regulatory standards. All these factors enhance the enjoyment of using our tool.

Acquire Get ME 1099ME 2017, implement the necessary modifications and adjustments, and obtain it in the preferred file format. Give it a try today!

- Modify and annotate the template

- The upper toolbar consists of the tools that assist you in highlighting and obscuring text, excluding images and visual elements (lines, arrows, and checkmarks, etc.), appending your signature, initializing, dating the document, and more.

- Arrange your documents

- Utilize the toolbar on the left if you wish to reorganize the document or remove pages.

- Prepare them for distribution

- If you intend to make the document fillable for others and share it, you can employ the tools on the right to add various fillable fields, signatures, dates, text boxes, etc.

Get form

The percentage you should use for tax withholding can vary based on your specific financial situation and the state's guidelines. Generally, following the tables provided by the IRS, you can determine the best percentage. Understanding the ME 1099ME also plays a crucial role in your tax responsibilities. If you find this process overwhelming, uslegalforms offers resources to simplify tax planning and compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.