Loading

Get Me 1099 And W-2g Instructions 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the ME 1099 and W-2G Instructions online

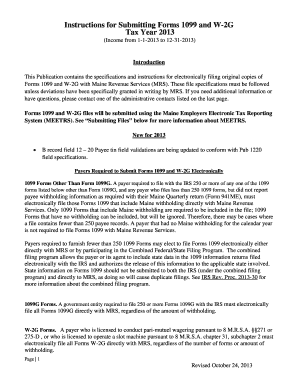

This guide provides clear and effective instructions for completing the ME 1099 and W-2G forms online. By following these steps, users can ensure accurate electronic filing with Maine Revenue Services.

Follow the steps to complete your forms online effectively.

- Locate and press the ‘Get Form’ button to access the ME 1099 and W-2G forms electronically.

- Review the information required in each section of the form. Ensure you have the necessary data such as taxpayer identification numbers and amounts.

- Begin with the T-record, which must include the payment year of 2013, followed by the transmitter’s TIN, name, contact information, and any required fields filled appropriately.

- Proceed to the A-record, confirming it includes the payer’s TIN and necessary information such as payer name and type of return.

- Complete the B-record with accurate details including the payee’s TIN, payment amounts, and any other relevant data required.

- Fill in the F-record to indicate the number of A records and total Maine withholding reported in the file.

- Once all sections are filled, review the form for any errors and ensure all data is accurate and complete.

- Finally, save your changes, and choose to download, print, or share the form as required.

Start completing your ME 1099 and W-2G forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To claim your W2G on your taxes, include the amount listed on the form in your overall income. Ensure you reference the ME 1099 and W-2G Instructions for any specific details needed for accurate reporting. If you need support, uslegalforms can provide the tools to help you navigate through your tax claiming process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.