Loading

Get Me 1099 And W-2g Instructions 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME 1099 and W-2G instructions online

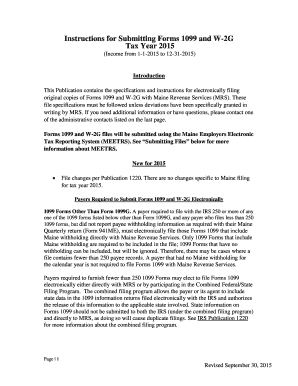

This guide serves as a comprehensive resource for individuals looking to fill out the ME 1099 and W-2G instructions online. It provides clear, step-by-step guidance tailored to your needs, ensuring a smooth process for electronic filing with the Maine Revenue Services.

Follow the steps to successfully complete your ME 1099 and W-2G instructions.

- Press the ‘Get Form’ button to access and open the form in the editor.

- Complete the T-Record section, starting with basic payer information, ensuring it matches the year of the filing. Include the transmitter's Taxpayer Identification Number (TIN) and contact details.

- Fill out the A-Record section, which includes your payer's TIN and indicates if the form is part of a combined Federal/State filing, which is typically blank for Maine submissions.

- Input the B-Records for each payee. This requires specific details, including the payee’s TIN, payment amounts, and address information. Be mindful to enter valid postal details and state abbreviations.

- Ensure all payment amounts are accurate and enter zeros for any unused amount fields.

- Complete the F-Record which totals the number of A Records submitted and the total Maine withholding reported. Verify that these values match your previous entries.

- Review the entire file for accuracy and compliance with specifications outlined in the guidelines, such as character limits and formats.

- Save your changes and prepare the file for electronic submission. Ensure that the file is in the correct text format with appropriate extensions, then proceed to submit the completed file through MEETRS.

Start completing your ME 1099 and W-2G forms online today for a seamless filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, an employee can receive both 1099 and W-2 income, particularly if they work a regular job while freelancing or working independently. Understanding how to handle both types is essential for accurate tax filings. Refer to the ME 1099 and W-2G Instructions for clarity. Platforms like UsLegalForms provide resources to help manage this effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.