Loading

Get Ca Ftb 3500a 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3500A online

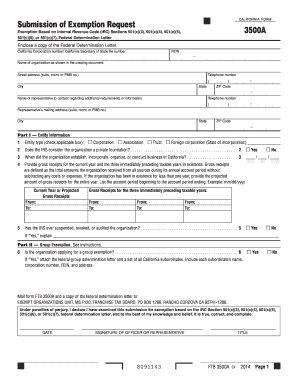

Filling out the CA FTB 3500A form is an essential step for organizations seeking tax-exempt status in California. This guide provides users with clear, step-by-step instructions for completing the form effectively online.

Follow the steps to complete the CA FTB 3500A online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your organization's California Corporation number or Secretary of State file number, along with the Federal Employer Identification Number (FEIN).

- Designate a representative for further communications by providing their contact name and telephone number.

- In Part I, check the applicable box for your entity type: Corporation, Association, Trust, or Foreign corporation. Also, indicate if the IRS classifies your organization as a private foundation.

- Provide gross receipts data for the current year and the previous three years. List the account period beginning and ending dates for each year recorded.

- In Part II, determine if you are applying for a group exemption. If ‘yes’, attach the federal group determination letter and list all California subordinates with relevant details.

- Review the form for completeness, sign, and date it at the designated line for the officer or representative.

Begin the process of obtaining tax-exempt status by completing your CA FTB 3500A online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can find your California adjusted gross income on your state tax return, typically located on Form 540 or Form 540NR. It’s the amount on which your state taxes are calculated and is essential for completing your CA FTB 3500A properly. If you have questions about calculating or retrieving this income, uslegalforms offers resources to assist you in navigating through your tax documents.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.