Loading

Get Md Cot/st 912 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD COT/ST 912 online

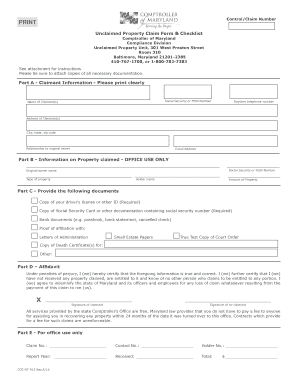

Filling out the MD COT/ST 912 online can streamline the process of claiming unclaimed property. This guide provides step-by-step instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part A - Claimant Information. Enter the name of the claimant or claimants clearly in the designated fields. Ensure the daytime telephone number, address, city, state, and zip code are accurate. Specify the relationship to the original owner and provide a valid email address for correspondence.

- Proceed to Part B - Information on Property Claimed. Though this section is designated for office use only, be prepared with the Social Security or Federal Employer Identification Number, the type of property being claimed, the holder's name, and the amount of property.

- In Part C, gather and upload the necessary documentation. You must provide a copy of your driver's license or another form of identification, as well as documentation showing your Social Security number. Include additional documents such as bank statements, proof of affiliation with the original owner, or other relevant legal papers.

- Complete Part D - Affidavit. Review the statements carefully and sign the form to certify that the information provided is true and correct. If applicable, a co-claimant may also sign here.

- Finally, ensure all sections of the form are filled out correctly, review for accuracy, and make any necessary edits. Once completed, you may save changes, download or print the form, and share it as needed.

Start filling out the MD COT/ST 912 online today to reclaim your unclaimed property.

The timeline for receiving unclaimed property in Maryland varies depending on several factors, including claim complexity and documentation accuracy. Generally, once a claim is submitted and verified, claimants can expect to receive their property within 30 to 90 days. Ensuring you follow the MD COT/ST 912 requirements will help expedite the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.