Get Irs 941 - Schedule B 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941 - Schedule B online

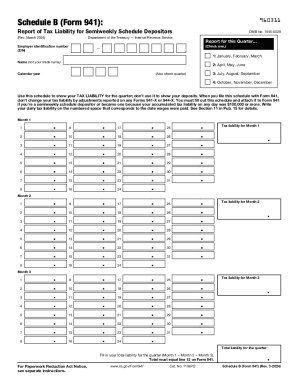

Filling out the IRS 941 - Schedule B is essential for employers who are semiweekly schedule depositors. This guide provides a step-by-step approach to accurately completing the form online, ensuring compliance with tax liabilities for your business. Follow these instructions to successfully navigate the form.

Follow the steps to complete your IRS 941 - Schedule B online.

- Press the ‘Get Form’ button to access the IRS 941 - Schedule B and open it in your preferred editor.

- Enter your employer identification number (EIN) in the designated field at the top of the form.

- Indicate the quarter for which you are reporting by checking the appropriate box for the specific months — choose from January to March, April to June, July to September, or October to December.

- In the 'Month 1' section, provide your daily tax liability for each date wages were paid throughout the month in the corresponding numbered spaces.

- Repeat the process for 'Month 2' and 'Month 3',' entering the daily tax liabilities accordingly.

- After inputting all daily liabilities for the three months, calculate your total liability for each month in the provided fields.

- Finally, compute the total liability for the quarter by summing Month 1, Month 2, and Month 3, ensuring this total matches line 12 on Form 941.

- Once you have completed the form, you can save the changes, download, print, or share it as needed.

Start completing your IRS forms online today!

Form 941, which is the Employer's Quarterly Federal Tax Return, can be filed electronically to the IRS. ... A payroll service provider that is approved for e-filing and an authorized IRS Authorized Signatory are the two options available to businesses to e-file form 941.

Fill IRS 941 - Schedule B

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this schedule with Form 941,. The IRS uses Schedule B to determine if you've deposited your federal employment tax liabilities on time. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Social security and Medicare taxes for 2025. Schedule B (Form 941) is a report of tax liability for Semiweekly Schedule Depositors, used to show the tax liability for the quarter. Schedule B, which accompanies Form 941, is a daily report of the employer's tax liability for federal income taxes withheld from employees. The IRS uses Schedule B to determine if you've deposited your federal employment tax liabilities on time. If you're a semiweekly schedule. Form 941 Schedule B is the Report of Tax Liability for Semiweekly Schedule Depositors.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.