Loading

Get Md Comptroller Mw506a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506A online

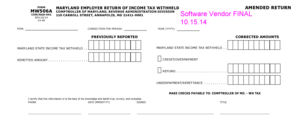

Completing the Maryland Employer Return of Income Tax Withheld (MW506A) is essential for employers who need to report their withheld income tax accurately. This guide provides detailed steps to help users fill out the form online efficiently.

Follow the steps to complete the MW506A form online.

- Use the ‘Get Form’ button to retrieve the MW506A form and access it in your preferred editing platform.

- Fill in your Federal Employer Identification Number (FEIN) in the designated field. This number is crucial for identifying your business for tax purposes.

- Indicate the correction period by entering the relevant dates and any applicable details regarding the amended return as necessary.

- In the section for 'Previously Reported Maryland State Income Tax Withheld', enter the amount that was reported in prior filings.

- Next, in the 'Remitted Amount' field, provide the total amount of income tax withheld that has been remitted to the state.

- Complete the 'Corrected Amounts' section by entering the revised figures for the Maryland state income tax withheld based on your records.

- If applicable, fill in the 'Credit/Overpayment Refund' field to indicate any amounts you are seeking to reclaim.

- Address any underpayment or remittance issues by entering the relevant details in the 'Underpayment/Remittance' area.

- Make checks payable to 'Comptroller of Maryland - WH Tax' for any amounts owed.

- Before finalizing the form, ensure you sign and date it appropriately, including your title and contact information.

- Once completed, save your changes. You have the option to download, print, or share the MW506A form as needed.

Complete your MW506A form online today to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To schedule an appointment with the Comptroller of Maryland, visit the official website for contact options and service requests. You can often book appointments online or call their office directly. The MD Comptroller MW506A information is also readily available during your appointment, allowing you to ask specific questions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.