Loading

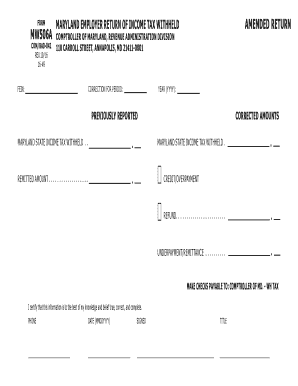

Get Md Comptroller Mw506a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506A online

Completing the MD Comptroller MW506A form is essential for employers in Maryland to report income tax withheld from employees. This guide provides clear, step-by-step instructions to help users successfully fill out this form online.

Follow the steps to complete the MD Comptroller MW506A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Federal Employer Identification Number (FEIN) in the designated field. This number is crucial for identifying your business in tax matters.

- Specify the correction period by indicating the year (YYYY) and any relevant details regarding the previous report.

- Report the previously reported Maryland state income tax withheld in the appropriate section. Enter this amount accurately to reflect what has been submitted in prior filings.

- Input the remitted amount in the next field, which should correspond to the actual amount submitted to the state for that period.

- Provide the corrected amounts for Maryland state income tax withheld in their respective fields. This update is essential to reflect any changes accurately.

- If applicable, fill in the credit or overpayment refund amount. This section allows you to request refunds for any overpayments made.

- Indicate any underpayments or remittances if applicable, ensuring all financial information is accounted for correctly.

- Make checks payable to 'Comptroller of MD - WH Tax' if you are submitting a payment along with your form.

- Provide your contact phone number, the date of completion (MMDDYYYY), and your signature, confirming that the information provided is true and complete.

- Finally, review the entire form for accuracy, then save your changes, download the form, print it, or share it as needed.

Complete your MD Comptroller MW506A form online for seamless submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To write a check to the Comptroller of Maryland, begin by writing 'Comptroller of Maryland' on the payee line. Include your account number and purpose in the memo line. For accurate processing, consult the MD Comptroller MW506A to ensure all necessary information is included.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.