Get Md Comptroller Cra 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller CRA online

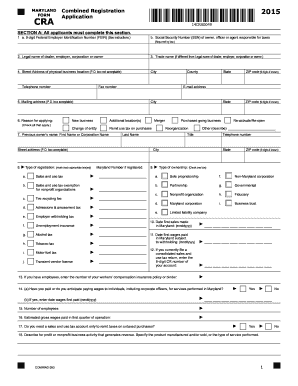

The MD Comptroller CRA, or Combined Registration Application, is essential for businesses to register for various tax accounts in Maryland. This guide will provide you with user-friendly, step-by-step instructions to complete this form online efficiently.

Follow the steps to complete your MD Comptroller CRA online.

- Press the ‘Get Form’ button to access the MD Comptroller CRA. This will open the form for you to begin filling it out.

- In Section A, complete all fields: Provide your nine-digit Federal Employer Identification Number (FEIN) and the Social Security Number (SSN) of the responsible owner or officer.

- Include the legal name of your business and any trade name, if applicable, in the designated fields.

- Fill in the physical street address of your business location; note that P.O. boxes are not acceptable.

- Provide your telephone number and fax number, if available, along with your city, state, and ZIP code.

- Indicate if you are a new business or if you have changed your entity. Check any relevant boxes related to your tax registration.

- Complete the reason for applying by checking all applicable options in the 'Reason for applying' section.

- In section 21, list all owners, partners, or corporate officers along with their SSNs and other requested information.

- If applying for an unemployment insurance account, complete Section B, ensuring to answer all questions accurately.

- Review all sections to ensure detailed information is correctly provided, and sign the application in Section F, confirming that the information is true and correct.

- Once completed, you can save your changes, download, print, or share the form as needed.

Start filing your MD Comptroller CRA online today to ensure your business is registered correctly!

Get form

Related links form

Recently, Maryland implemented new tax laws impacting retirees, particularly relating to pensions and retirement income. These changes aim to provide tax relief for eligible retirees, potentially reducing their taxable income significantly. Keeping informed about these updates from the MD Comptroller can help you effectively plan your finances and ensure compliance. Utilizing USLegalForms can assist you in understanding how these laws apply to you.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.