Loading

Get Md Comptroller 502x 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 502X online

This guide provides clear and comprehensive instructions for users on how to fill out the MD Comptroller 502X form online. Following these steps will help ensure that your amended tax return is completed accurately and submitted effectively.

Follow the steps to successfully complete your MD Comptroller 502X online.

- Press the ‘Get Form’ button to download the MD Comptroller 502X form and open it in your preferred editor.

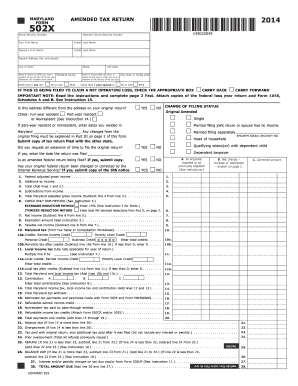

- Fill in your Social Security Number and your spouse's Social Security Number, if applicable. Enter your first name, middle initial (if any), and last name, followed by the same information for your spouse.

- Provide your current address including street number, city or town, and zip code. Specify the name of the county where you were a resident as of the last day of the tax year.

- Indicate if you or your spouse were 65 or over or blind by checking the appropriate boxes.

- Respond to the initial questions regarding your filing status and whether this address differs from the one on your original return. Indicate if you are a full-year resident, part-year resident, or nonresident.

- Select your current filing status from the provided options, ensuring it aligns with your prior return.

- Complete page 2 of the form, detailing your income and adjustments from your federal return. If no changes were made to your income or deductions, indicate this in the respective columns.

- In the deduction section, enter any itemized deductions from your previous return. If applicable, provide details for increases or decreases.

- Use Part III to explain any changes to your income, deductions, or credits. Attach necessary supporting documents.

- Proceed to fill out tax calculations, such as Maryland adjusted gross income, deductions, and any applicable credits.

- Review the balance due or refund sections. Calculate any remaining balances by subtracting payments and credits from your total tax liability.

- Once all sections are completed, ensure to save your changes. Download or print your finished form for submission as needed.

Complete your MD Comptroller 502X form online today for an accurate and efficient filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To write a check to the Comptroller of Maryland, begin by filling out your check with the correct amount for your taxes. Make it payable to the "Comptroller of Maryland" and include your Social Security number or Maryland taxpayer ID on the memo line. Ensure you mail it to the correct address specified on the MD Comptroller 502X instructions to avoid processing delays.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.