Loading

Get Md Comptroller 502b 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 502B online

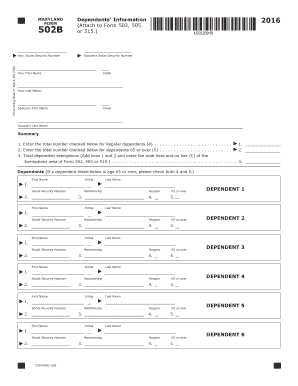

Filling out the MD Comptroller 502B form can seem challenging, but with this step-by-step guide, you will be able to complete it effortlessly. This form collects information about your dependents and is essential for your tax filings.

Follow the steps to successfully complete the form online:

- Click the ‘Get Form’ button to access the MD Comptroller 502B form and open it in your preferred digital editor.

- Provide your social security number in the designated field at the top of the form.

- Using blue or black ink, print your first name, middle initial, and last name in the appropriate spaces.

- If applicable, enter your spouse's social security number, first name, middle initial, and last name in the provided sections.

- In the 'Dependents' section, begin by determining the number of regular dependents you are claiming. Count the total and enter that number in the corresponding box.

- Next, identify any dependents who are 65 or older and enter that total in the designated area.

- Add the totals from the previous two steps together to get your total number of dependent exemptions and enter this final number in the appropriate box.

- If needed, fill out the detailed information for each dependent, including their first name, middle initial, last name, social security number, and relationship to you.

- After completing all fields, review the filled form carefully for accuracy and completeness.

- Finally, save your changes, download the completed form, print a copy for your records, or share it as necessary.

Complete your forms online today to ensure accurate and timely submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Certain taxpayers may qualify for exemptions from the underpayment penalty, particularly if their tax owed is below a specific threshold. Additionally, if you meet particular criteria such as being a new taxpayer or facing unusual circumstances, you might be exempt as well. The MD Comptroller 502B details these exemptions, providing clarity on the requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.