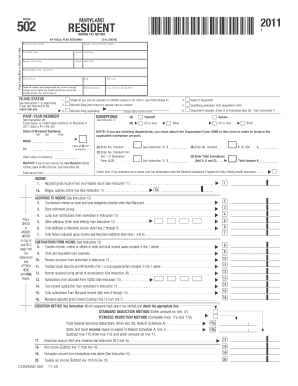

Get Md Comptroller 502 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MD Comptroller 502 online

How to fill out and sign MD Comptroller 502 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filing your income and presenting all essential tax documents, such as MD Comptroller 502, is a responsibility unique to a US citizen. US Legal Forms simplifies tax preparation, making it more accessible and precise.

How to fill out MD Comptroller 502 online:

Keep your MD Comptroller 502 stored securely. Ensure all relevant documents and information are properly organized while staying mindful of deadlines and tax regulations set by the IRS. Make it simple with US Legal Forms!

- Access MD Comptroller 502 in your web browser from any device.

- Click to open the fillable PDF file.

- Begin filling out the online template field by field, following the instructions of the advanced PDF editor's interface.

- Accurately enter text and numbers.

- Select the Date field to automatically insert the current date or adjust it manually.

- Utilize Signature Wizard to create your unique e-signature and sign it in moments.

- Consult the Internal Revenue Service guidelines if you have any remaining questions.

- Press Done to save the changes.

- Continue to print the document, save it, or send it via email, text message, fax, or USPS without leaving your browser.

How to modify the Get MD Comptroller 502 2011: personalize forms online

Complete and endorse your Get MD Comptroller 502 2011 promptly and accurately. Acquire and amend, and sign adjustable form templates within the ease of a single tab.

Your document process can be significantly more effective if all necessities for altering and overseeing the workflow are consolidated in one location. If you are looking for a sample of the Get MD Comptroller 502 2011 form, this is the destination to obtain it and complete it without seeking external solutions. With this smart search engine and editing application, you won’t have to look any further.

Simply enter the name of the Get MD Comptroller 502 2011 or any other form and discover the suitable sample. If the sample appears relevant, you can begin modifying it immediately by clicking Get form. There’s no necessity to print or even download it. Hover and click on the interactive fillable fields to add your details and sign the form in a single editor.

Utilize additional editing instruments to tailor your template: Check interactive checkboxes in forms by selecting them. Review other sections of the Get MD Comptroller 502 2011 form text by employing the Cross, Check, and Circle devices.

Save the form on your device or convert its format to your desired type. When armed with an intelligent forms catalog and a robust document editing solution, handling documentation becomes less complicated. Locate the form you require, fill it out instantly, and endorse it on the spot without downloading it. Simplify your paperwork routine with a solution designed for modifying forms.

- If you wish to input additional text into the document, employ the Text tool or append fillable fields with the appropriate button.

- You can even define the content of each fillable field.

- Incorporate images into forms with the Image button. Upload pictures from your gadget or take them with your computer camera.

- Integrate custom visual components into the document. Utilize Draw, Line, and Arrow tools to sketch on the document.

- Sketch over the text in the document if you want to obscure it or emphasize it.

- Conceal text sections with the Erase, Highlight, or Blackout tool.

- Incorporate custom features such as Initials or Date with the respective tools. They will be generated automatically.

Get form

Related links form

The Maryland form 502R is used for claiming various tax credits on your MD income tax return. This form includes credits for prepayment of taxes, your eligibility for certain tax benefits, and other adjustments to your tax calculation. Completing the 502R accurately helps ensure that you maximize your credits and reduce your overall tax bill on the MD Comptroller 502.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.