Loading

Get Keystone Clgs-32-1 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KEYSTONE CLGS-32-1 online

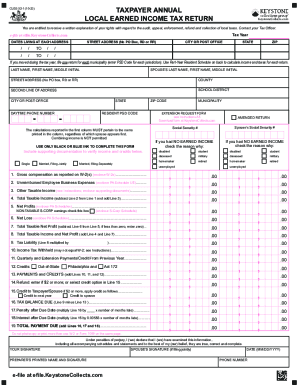

The KEYSTONE CLGS-32-1 is the Taxpayer Annual Local Earned Income Tax Return form that must be accurately completed by individuals for their local earned income tax obligations. This guide aims to provide a detailed, step-by-step walkthrough to assist users in filling out the form online effectively.

Follow the steps to ensure your form is completed accurately

- Click the ‘Get Form’ button to access the online version of the KEYSTONE CLGS-32-1 and open it for editing.

- Begin by entering the tax year at the top of the form. This is crucial for identifying the tax period you are filing for.

- Fill in the dates lived at each address. Record the start and end dates clearly for each residence during the tax year.

- Include the street address for your current residence, ensuring that no PO Box, RD, or RR is noted.

- Input your last name, first name, and middle initial, as well as your spouse’s information if applicable. Make sure names match official documents.

- Complete the city, state, and ZIP code fields accurately to reflect your current residential status.

- Indicate your daytime phone number for further inquiries or communications.

- Report your gross compensation as reported on W-2 forms, including necessary supporting documentation to verify your income.

- Proceed to input any unreimbursed employee business expenses, ensuring that you enclose the PA Schedule UE if applicable.

- Calculate your total taxable income. This is done by subtracting line 2 from line 1 and adding any other taxable income reported.

- Fill in any credits and payments. Ensure you check all lines carefully to avoid discrepancies.

- Review the calculated tax liability and balance due, which must accurately reflect all inputs and deductions.

- Sign the form at the designated area, and include your spouse’s signature if filing jointly.

- Once you are finished, you can save your changes, download the form, print it, or share it as needed.

Complete your KEYSTONE CLGS-32-1 form online today and ensure your local tax obligations are met efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.