Loading

Get Wi Dor Pw-2 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR PW-2 online

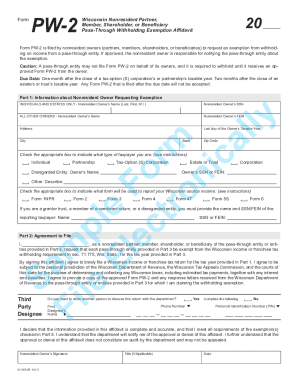

The WI DoR PW-2 form is essential for nonresident owners seeking an exemption from withholding on income from pass-through entities. This guide provides clear and comprehensive instructions for accurately completing the form online.

Follow the steps to fill out the WI DoR PW-2 effectively.

- Press the ‘Get Form’ button to access the form and display it in the online editor.

- In Part 1, provide your nonresident owner's Social Security Number (SSN) or Federal Employer Identification Number (FEIN). Enter your full name (last, first, middle initial) and your address, including city, state, and zip code. Indicate the last day of your taxable year and check the box that represents your taxpayer type, such as 'Individual' or 'Partnership.'

- Continue in Part 1 by selecting which form will be used to report your Wisconsin source income. Options include Form 1NPR, Form 2, and others. If applicable, provide the name and SSN/FEIN of the reporting taxpayer if you are a grantor trust or disregarded entity.

- In Part 2, sign the affidavit confirming your request for exemption. Make sure to include your signature, date, and title if applicable. Indicate if you wish to authorize a third party to discuss this return with the department by checking ‘Yes’ or ‘No’ and providing the designee's name and phone number if applicable.

- Move to Part 3 and enter the name and FEIN or SSN of the pass-through entity. Complete the address and indicate the last day of that entity's taxable year. Select the appropriate type of pass-through entity, such as 'Partnership' or 'Tax Option (S) Corporation.'

- In Part 4, provide the amount of Wisconsin income and credits you received from the pass-through entity. Ensure that the amounts are accurate and sufficient according to the guidelines provided.

- In Part 5, check all applicable reasons for exemption. Fill in any required amounts and explanations where necessary. Be thorough to ensure clarity in the determination of your exemption.

- After completing all sections, review your entries for accuracy. You can then save your changes, download the completed form, print it, or share it as required.

Complete the WI DoR PW-2 online to ensure a smooth filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.