Loading

Get Md 502d 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD 502D online

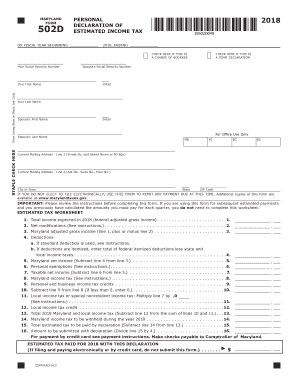

The MD 502D is the personal declaration of estimated income tax for residents of Maryland. This guide provides step-by-step instructions on how to complete the form online to ensure compliance with state tax obligations.

Follow the steps to accurately fill out your MD 502D online.

- Click 'Get Form' button to obtain the form and open it in your online editor.

- Begin by entering your Social Security number and your partner's Social Security number if applicable. Ensure to keep this information confidential and secure.

- Fill in your first and last name. If applicable, include your partner’s details as well. Use blue or black ink if you are printing the form.

- Provide your current mailing address, including any apartment or suite numbers, city, state, and ZIP code. Double-check for accuracy as this information is vital for correspondence.

- Complete the estimated tax worksheet sections. Begin by entering your total expected income for 2018 on line 1. Make sure to include all taxable sources of income.

- On line 2, enter any net modifications as instructed. This may include specific additions and subtractions to your federal adjusted gross income.

- Calculate your Maryland adjusted gross income by completing line 3, which is the total income plus or minus modifications.

- Proceed to fill in deductions on line 4, whether you choose standard or itemized deductions, as per the guidance provided.

- Continue filling out the form by completing the subsequent lines with necessary calculations for personal exemptions, taxable income, and tax credits.

- Once all fields are accurately filled, review the form for any errors before saving your changes. You may choose to download, print, or share the completed form as needed.

Complete your MD 502D declaration online today to meet your tax obligations with ease.

Related links form

To fill out a withholding allowance form, start by entering your personal information and selecting the number of allowances you are claiming. Make sure to review the specific instructions provided for the form, as they can vary based on state requirements. Resources like uslegalforms can assist you in accurately completing this process related to the MD 502D.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.